Last week, Ayr Strategies (CSE: AYR.A) reported their second-quarter financials and reached an agreement to enter Pennsylvania by acquiring six retail dispensaries and a “significant cultivation and production footprint” for $57 million. Ayr generated $28.3 million in revenue this quarter down from $33.6 million last quarter. They had gross profits of $23.5 million, which is $3.2 million higher than the previous quarter and had an adjusted EBITDA of $9.1 million.

Two analysts raised their price targets on Ayr Strategies, Andrew Semple of Echelon Wealth raises his price target to C$23 while Bobby Burleson from Canaccord raised his to C$25. Five analysts cover the stock. Four analysts have a buy rating while one has a strong buy rating. The current mean price target is C$21.70, or a 33% upside to the stock. The highest price target comes from Russell Stanley of Beacon Securities with a C$31 price target, and the lowest comes from Roth Capital with a C$14 price target or a 14% downside.

In Canaccord’s note Friday morning, Burleson says that, “AYR reported in line Q2/20 results that reflected strong execution despite a challenging macro backdrop in the company’s existing market.” Burleson then went on to state that Ayr is operating at the same scale as top-tier MSO’s in the industry in its core markets, and “appears poised for significant growth” with this Pennsylvania acquisition.

Burleson said that although the move into Pennsylvania is a great one, he notes that they will need to raise money to complete the acquisition. Canaccord gives us some great insight into the valuation of the deal. The firm states that the expected price is about 2.5x forward EBITDA. The existing operator has a 143k sq foot cultivation and processing facility that is still being built but has ~45k sq feet completed, this all is what Ayr will be acquiring.

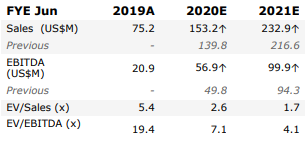

Alongside upgrading their 12-month price target from C$17.50 to C$25 while reiterating their speculative buy rating, Burleson increases his full-year 2020 and 2021 revenue and EBITDA estimate. These updated estimates do not include any Pennsylvania revenue stemming from this transaction and subsequent growth. Canaccord now estimates that 2020 and 2021 revenue will be $153 million and $233 million, while EBITDA is $56.9 million and $99.9 million, respectively.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.