On March 10th, Ayr Wellness (CSE: AYR.a) reported their fourth quarter and year end financial results. They posted quarterly revenues of U$47.76 million, an adjusted EBITDA of U$19.35 million, along with a net loss of U$143.58 million. Full year numbers came in at U$155.1 million, U$56.19 million, and -U$176.3 million, respectively. These numbers generally came in line with the average analyst estimate. You can find what analysts were expecting out of this quarter and full fiscal year here.

Ayr Wellness currently has four analysts covering the company with a weighted 12-month price target of C$58. This is up from the average before the results, which was C$54.60. One analyst has a strong buy rating and the other three have buy ratings. The street high comes from Beacon Securities with a C$76 price target, and the lowest target comes from PI Financial with a C$60 price target.

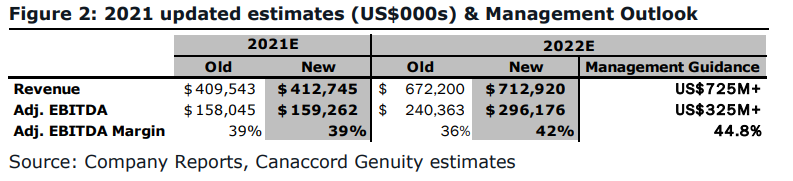

In Canaccord’s note on the 11th, they were the only analyst to upgrade their 12-month price target, raise the target from C$60 to C$70. Matt Bottomley, Canaccord’s analyst headlines, “Q4/20: Nevada headwinds weigh on QoQ growth while Ayr provides encouraging FY2022 outlook.”

Onto their estimates, Ayr came slightly below their estimates. They forecasted U$50.26 million and U$21.65 million for revenue and adjusted EBITDA, respectively. Bottomley attributes this miss mainly from COVID headwinds, specifically in Nevada, where states sales were down quarter over quarter. But in its other key state Massachusetts, it reported a 22% quarter over quarter increase in wholesale sales with its products in 78 out of the 110 retail dispensaries.

Bottomley believes that the company has sufficient capital to carry out its expansion promises as well as close all pending M&A, with its U$245 million in cash on hand.

The company reaffirmed its guidance for M&A closing dates. During this quarter, the company closed both PA acquisitions and the Liberty Health Sciences deal after the period end. The company is still on track to close its AZ and OH transactions later this month, with the New Jersey acquisition expected to close this summer. Bottomley writes, “We believe Ayr is on track to increase its US exposure, from its historical legacy markets of MA and NV to seven high-growth states, in the relatively near term.”

Below you can see Canaccord’s new 2021 and 2022 guidance. There is a slight divergence between Canaccord’s 2020 numbers and management guidance.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.