On April 11th, Endeavour Silver Corp. (TSX: EDR) announced its first quarter of 2021 production results. The company announced production of 1,314,955 silver ounces and 8,695 gold ounces, which equates to a total of 2.0 million silver equivalent ounces.

Silver production increased 25% year over year, while gold production dropped by 22%, resulting in its silver equivalent ounces growing 4% year over year. The company reported its throughput decreased 2% to 206,147 tonnes for the quarter.

Additionally, the firm said it sold 1,717,768 ounces of silver and 8,381 ounces of gold this quarter and had 608,788 silver ounces and 1,911 gold ounces in inventory, on top of 59,594 silver and 1,931 ounces in concentrate inventory.

Endeavour Silver currently has 7 analysts covering the stock with an average 12-month price target of C$7.58, or a 10% upside to the current stock price. Out of the 7 analysts, 2 have buy ratings while the other 5 have hold ratings on the name. The street high sits at C$11.05 which is a 60% upside to the current stock price.

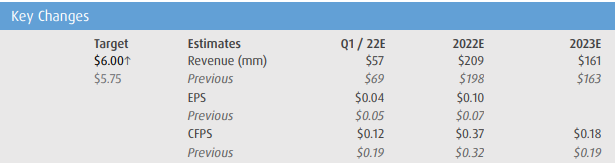

In BMO’s note on the production results, they reiterate their market perform rating and raise their 12-month price target from $5.75 to $6.00, saying that the company is starting the year out strong.

On silver production results, BMO says that Endeavour beat their estimates by 17%, with Bolañitos production coming in at 181.1k ounces versus their 127.5k ounce estimate. They say that the production beat was primarily driven by “higher silver head grade and increased mill throughput.” Endeavor’s Guanacevi mine produced 1,134k silver ounces, beating BMO’s estimate by 14%.

On gold production, Endeavour slightly beat BMO’s estimate of 8,300 ounces, coming in 5% higher. Once again, Guanacevi was the primary mine that beat expectations as they produced 3.500 ounces versus BMO’s estimate of 2,800 ounces.

Lastly, BMO touches on Endeavour selling down its silver inventory, commenting that the company sold roughly 400,000 ounces more than in previous quarters. Because of this, they have lifted their next twelve months’ cash flow estimates higher.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.