On August 18, Ayr Wellness (CSE: AYR.A)s reported its second quarter financial results. The company announced that revenues decreased by 1% to $110.1 million, while gross profits declined 11.5% to $40.3 million. Additionally, the company saw a wider operating loss, coming in at $24.8 million versus a $21.1 million loss in the previous quarter.

The company said it ended the quarter with $116.7 million, bolstered by $81.5 million in sale-leasebacks completed during the quarter. Lastly, the company is taking measures to update its 2022 full-year guidance, saying that they expect revenue, adjusted EBITDA, and operating income to grow 10% sequentially and in an “acceleration in the pace of sequential growth in Q4 2022.”

The company targets an annualized run rate of $250 million of adjusted EBITDA, $100 million of operating income, and $800 million annualized revenue by the fourth quarter.

Ayr Wellness has six analysts covering the stock with an average 12-month price target of C$27.83, or an upside of 418%. Out of the six analysts, two have strong buy ratings, and the other four have buy ratings. The street high price target sits at C$37, representing an upside of 590%.

In Canaccord Genuity Capital Markets’ note on the results, they reiterate their buy rating but slash their 12-month price target on the stock to C$30 from C$40, saying that following the quarter, they have made “meaningful reductions to our near-term estimates.”

On the results, Ayr Wellness missed most of Canaccord’s estimates. Canaccord expected revenues to come in at $117.3 million, with an adjusted gross margin of $61.2 million. Operating costs were expected to come in at $46.2 million with adjusted EBITDA of $19.6 million. Net losses were also expectedto come in at just $2.9 million.

All the results materially came below Canaccord estimates, with Canaccord suggesting that this was due to the meaningful growth drivers coming too late into the quarter.

On the company’s updated full-year 2022 guidance, Canaccord says that they expect the second half of the year to have a slower ramp; they believe that the core growth drivers “remain in place.” These drivers include a full quarter of adult use in New Jersey, opening its two recreational stores in Massachusetts, increased sales in Arizona, and additional retail store openings in Florida and Pennsylvania.

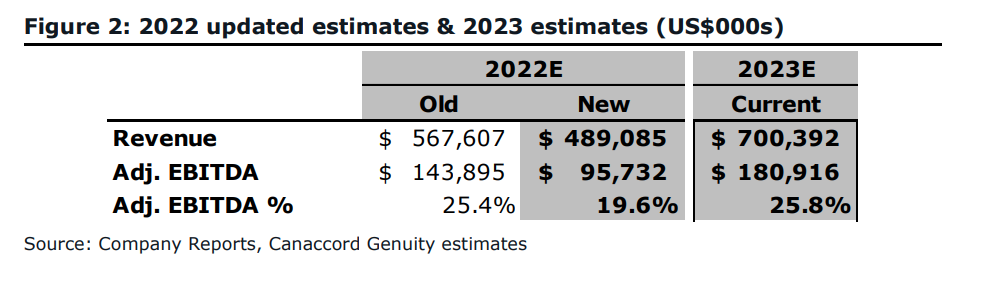

Below you can see Canaccord’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.