Consolidation within the gold sector continues, with B2Gold (TSX: BTO) this morning revealing it has reached a definitive agreement to acquire Sabina Gold & Silver Corp (TSX: SBB) in an all-share transaction.

The deal will see B2Gold acquire the firm at a rate of 0.3867 of a B2Gold share for each Sabina share held, equating to a per-share value of $1.87. Overall, the exchange rate values Sabina at roughly $1.1 billion, representing a 45% premium to the 20-day volume weighted average price of the firm. The premium however is just 18% based on Friday’s close of $1.58.

B2Gold $BTO said on Monday it will acquire Sabina Gold & Silver Corp $SBB in a deal valued at C$1.1 billion ($823.66 million), in a move that is likely to boost the Canadian gold miner's portfolio.

— The Dive Feed (@TheDeepDiveFeed) February 13, 2023

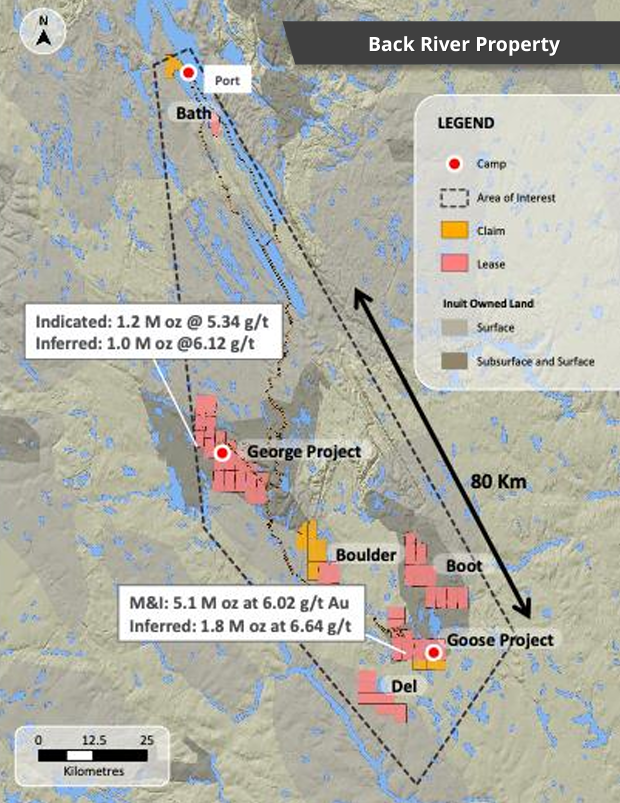

The purchase of Sabina will bring the firms Back River Gold district in Nunavut, Canada to that of B2Gold, which it wholly owns. A 2021 feasibility study indicates the flagship Goose project is capable of producing 223,000 ounces of gold per year over a 15-year mine life, with current mineral reserves amount to 3.6 million ounces at 5.97 g/t gold. Cash costs are estimated at US$679 per ounce, with all in sustaining costs pegged at US$775 per ounce.

Pre-stripping of the project has already begun, and 97% of procurement for the project is said to have already been completed.

Untapped exploration potential is said to exist elsewhere at Back River, with five current known deposits along an 80 kilometre belt remaining open and providing potential for mine life extension.

“B2Gold has strong construction expertise and experience to successfully develop the fully permitted Goose project and unlock considerable value for the shareholders of both Sabina and B2Gold. The Back River Gold District has multiple high-potential mineralized zones which remain open, and we are confident that the district has strong untapped upside with numerous avenues for resource growth,” commented B2Gold CEO Clive Johnson on the transaction.

The deal remains subject to shareholder approval, with a special meeting slated to occur in April 2023. The transaction is currently slated to close in Q2 2023, pending customary approvals.

B2Gold last traded at $4.83 on the TSX.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.