PishPosh, a small baby-goods shop that wanted to list under the ticker BABY, had its initial public offering postponed due to little demand, in a rare occurrence of a stock failing to begin trading on the day of its scheduled market debut.

About 3:38 p.m. ET on Wednesday, Nasdaq said in an advisory that the IPO had been “voluntarily postponed at the direction of the underwriter,” adding that all Nasdaq systems were operational regularly. Stocks in an IPO often begin trading in the morning or early afternoon.

According to a securities filing, Boustead Securities was the primary underwriter of the IPO.

PishPosh, based in New Jersey, announced Wednesday morning that it had priced its shares at $5 in the IPO, with around 1.82 million common shares intended to raise $9.1 million for the company.

Why is it taking @nasdaq so long to push the $BABY @pishposhbaby out? Looks like the opening autcon may be far below the $5 IPO price. @TripleDTrader pic.twitter.com/af6naplqP9

— James J. Angel (@GuFinProf) March 8, 2023

But, demand for the stock was insufficient for the shares to begin trading at that price. According to a person familiar with the case who told The Wall Street Journal, the indicative price in the opening auction—an estimate of where the stock will begin trading based on demand from buyers and sellers—remained much below $5 in the hours before the deal was withdrawn.

PishPosh is yet another story amongst the declining IPO market. The number of firms that filed for an initial public offering in 2022 decreased by nearly half from the previous year’s record pace.

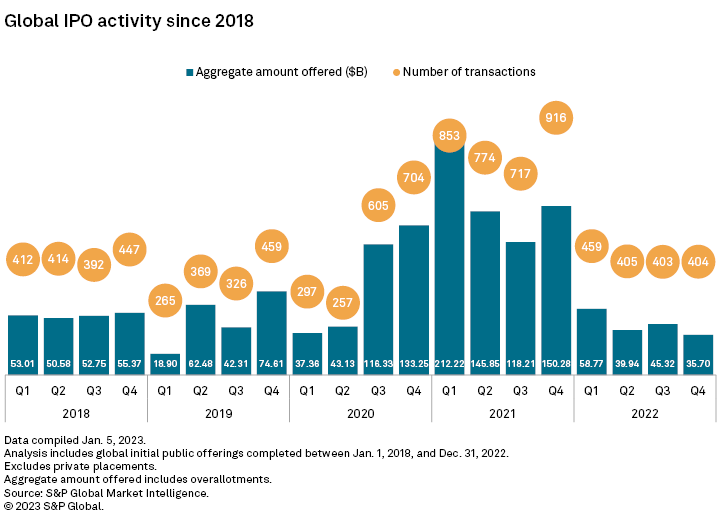

In 2022, there were 1,671 IPOs launched globally, compared to 3,260 in 2021. According to S&P Global Market Intelligence statistics, the total amount issued in those IPOs in 2022 fell to $179.73 billion, down from $626.56 billion in 2021. The poor performance of shares in 2022, aggressive rate hikes by central banks, and fears of a worldwide recession all stifled activity in public markets.

In the fourth quarter of 2022, 404 IPOs were issued globally, almost the same amount as in the previous two quarters. The value of the offerings totaled $35.70 billion, the lowest amount offered in a period since the first quarter of 2019, when 265 IPOs totaled $18.90 billion.

In comparison, 916 IPOs worth $150.28 billion were launched in the fourth quarter of 2021.

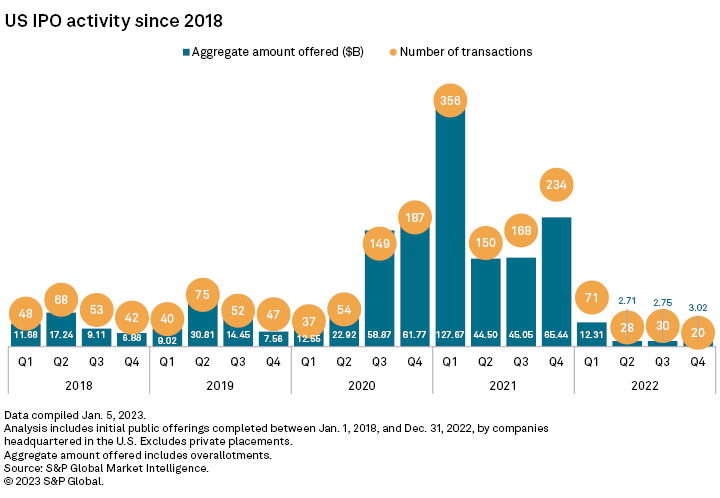

IPO activity in the US contributed to much of the market cooldown. Twenty IPOs in the US were launched during Q4 2022, worth $3.02 billion in all. This compares to 234 IPOs totaling $65.44 billion in the same quarter last year.

For the whole year, there were 149 IPOs in the United States in 2022, totaling $20.79 billion, compared to 908 IPOs in 2021, totaling $282.66 billion.

Information for this briefing was found via The Wall Street Journal, SPGlobal, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.