The Bank of America has increased its 18-month gold target from $2,000 to $3,000 per ounce to coincide with the various monetary and fiscal policies being put into action amid the coronavirus pandemic. The target was provided in a report entitled “The Fed can’t print gold,” which succinctly provides the justification for the price target.

When an economy suddenly shrinks its output, bank balance sheets rise significantly, meanwhile the government responds by increasing fiscal expenditure. Such commotion can cause fiat money to become essentially worthless, thus reducing the store of value to only physical commodities such as precious metals.

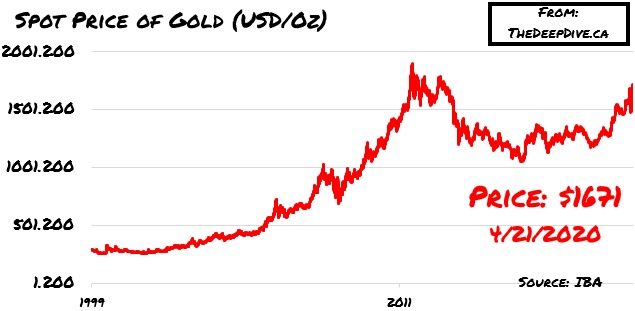

Bank of America is anticipating bullion gold, which is the emergency currency of choice by governments and private investors alike, to reach an average of $1,695 per ounce in 2020, and then is expecting it to continue increasing to at least $2,063 in 2021. Thus far, the record for the highest bullion gold prices was set in 2011, at a price of $1,921.17 – a record which is very attainable given that spot prices have already increased by 11% thus far this year.

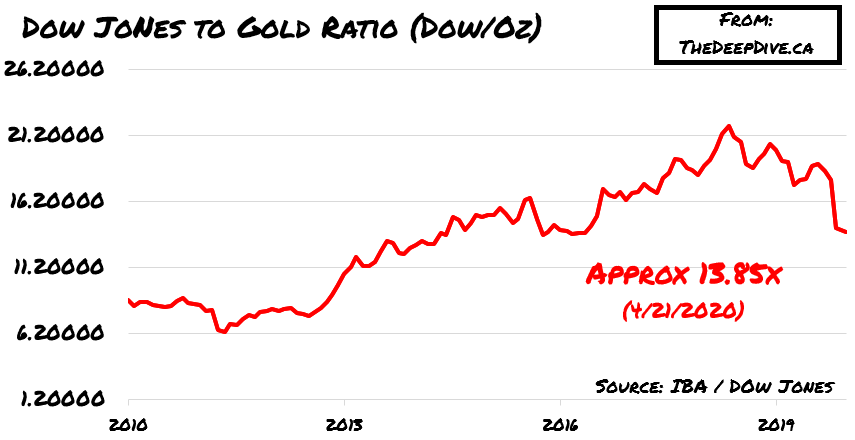

Even with Gold’s recent run, the price hasn’t changed much relative to the Dow.

Gold prices are still faced with several obstacles which may prevent them from soaring to extraordinary levels, such as reduced demand for jewelry in China and India, decreased economic volatility, as well as a potentially strong dollar.

Information for this briefing was found via Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.