With widespread inflation-anticipation driving a bull market in gold, the TSX Venture exchange is building its COVID recovery around a few rapidly maturing juniors, so The Dive is bringing you a closer look, starting with Great Bear Resources (TSXV: GBR).

Great Bear became a consistent name atop the volume traders after a grand entrance in the summer of 2017. It started pulling consistent high-grade gold intersections out of diamond drill holes out of their Dixie Project in Ontario’s Red Lake Camp which, until recently, the company owned a 100% interest in.

The discovery caught the attention of Red Lake veteran Rob McEwen, who once ran Goldcorp (since taken over by Newmont (TSX: NGT), but now runs McEwen Mining (TSX: MUX), and knows what to do with a high-grade gold discovery in Red Lake, Ontario. McEwen financed the operation immediately and, with a bit of a tailwind from the gold price, GBR has been putting on a clinic about how to de-risk a high-grade gold asset and make it count.

Since the discovery, Great Bear has moved its price from $1.50 to $11.50. The seven-fold price increase came with only a doubling of the share count, done with two conservative financings, whose warrants were in the money almost as soon as the paperwork showed up. Great Bear raised more than $20 million in 2019, and shareholders can be very pleased with how it was used.

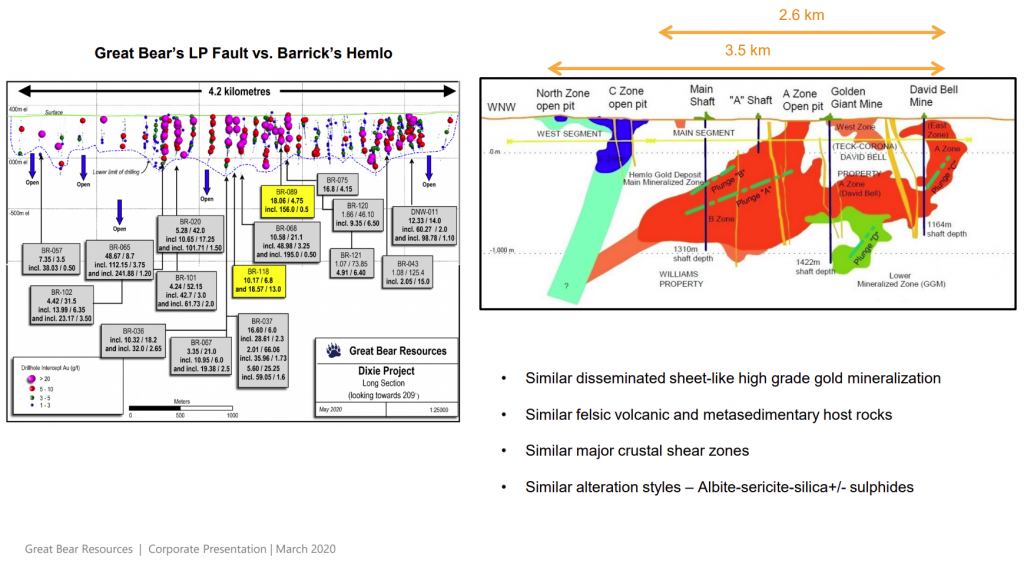

Coming into its third year post discovery, Great Bear has yet to publish a reserve or resource estimate, or a preliminary economic assessment on the Dixie Project. At these grades, at these spacings, with the consistency being achieved, nobody is clamoring for one. The geology-oriented corporate literature features a side-by-each comparison to the Red Lake-Hemlo trend, and management is very happy to let their cross sections and long sections speak for themselves. This is an investor’s deck for the heads. The “Real Ones Know” of the junior gold world.

We can’t put enough emphasis on how much owning the Dixie Property in its entirety has helped the company build so far. There are no joint venture partners to compete with for investor interest, or end up being a weak hand, to be exploited by a major looking to buy an inside track. The only royalty on this property is one the company created.

A 2% NSR in the Dixie Project was put into a spin-out co with $500,000 and “certain marketable securities,” which sounds like it’s probably a bunch of junior explorers that have a habit of trading sideways until they get rolled back, so they’ve been hanging around in the account for a while, because they aren’t worth selling. This company is getting more relatable all the time.

Management teams know their audiences in the most elemental and personal kind of way when they walk among them. Great Bear plays into the core biases of gold stock enthusiasts without even having to try. Management is doing what every died-in-the-wool gold stock junky would do with a high-grade asset in an established mining camp in a known jurisdiction. At least, what they think they’d do.

GBR’s intention to use the corporation itself to deliver the value in this asset is apparent by the fact that they’ve taken care of the cap table. Management who are most interested in enriching themselves through their shareholdings in a successful company is a cliche because it’s often a lie. In this instance, at least up to this point, it is an objective truth.

The company announced a $33 million private placement May 12th. The financing creates a grand total of 2,195,600 shares. There are no warrants. The flow through portion of the bought deal is priced at $17/share – a 48% premium to the market. That kind of pricing chases away investors who wanted to use the tax write off to bump down their cost and flip it, making more stock available for long term outlook types who want to climb aboard.

Information for this briefing was found via Sedar and Great Bear Resources. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.