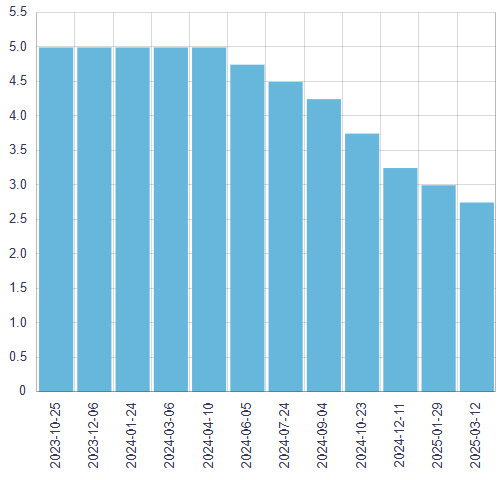

The Bank of Canada announced today a 25 basis point reduction in its target for the overnight rate, bringing it to 2.75%. This marks the seventh consecutive rate cut, as the central bank grapples with escalating trade tensions and tariffs imposed by the United State.

Despite a strong start to 2025, with inflation near the 2% target and robust GDP growth, the Canadian economy now faces significant headwinds. The Bank of Canada cited heightened trade tensions and U.S. tariffs as factors likely to slow economic activity and increase inflationary pressures.

The decision comes in the wake of U.S. President Donald Trump’s recent imposition of tariffs on Canadian goods, some of which were implemented last week. This trade conflict has injected uncertainty into the economic outlook, prompting the Bank of Canada to take preemptive action.

Canada’s economy showed resilience in late 2024, with GDP growth of 2.6% in the fourth quarter, surpassing earlier projections. However, recent surveys indicate a sharp drop in consumer confidence and a slowdown in business spending, as companies postpone or cancel investments due to trade uncertainties. The labor market, which had been strengthening with the unemployment rate declining to 6.6%, now shows signs of stalling. February saw job growth come to a halt, raising concerns about the potential disruption to the jobs market recovery.

Inflation remains close to the 2% target, with January’s CPI slightly firmer than expected at 1.9%. The Bank of Canada anticipates inflation to increase to about 2.5% in March as a temporary tax break ends.

Governor Tiff Macklem emphasized that while monetary policy cannot offset the impacts of a trade war, the central bank must ensure that higher prices do not lead to ongoing inflation.

Economists had widely anticipated this rate cut, with market odds jumping to 90% following the imposition of U.S. tariffs on Canadian exports. The decision aligns with the global trend of central banks adjusting monetary policies in response to trade-related economic uncertainty.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.