Last week the Bank of Canada announced sweeping new measures to add liquidity to the system. In an introduction, they indicated they would increase measures to keep the economy running as the virus continues disrupt everyday life:

The COVID-19 pandemic represents a serious health threat to people around the world, and a significant disruption to daily life. It is having a major impact on the global and Canadian economies. Every sector of the Canadian economy will be affected. Some sectors, such as the energy, travel and hospitality and service industries, are being particularly hard hit.

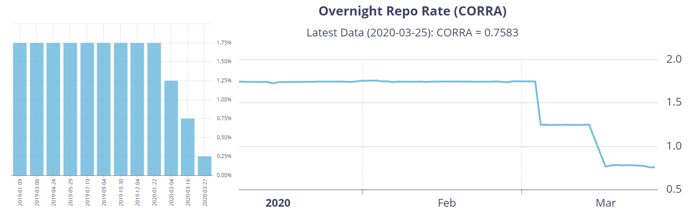

Monetary Policy, Heading Towards Zero

They have started by lowering their overnight repo rates to near zero. In case you’re new to this, overnight rates are set for interbank lending where the Bank of Canada (BoC) is the lender of last resort to be used at the end of each day; aimed to ensure maintenance of the capital adequacy guidelines.

And this morning in a surprise press conference, BoC Governor Stephen Poloz took to the podium to discuss the move towards 25 basis points. He told us they are not contemplating negative rates and the emphasis is on market functioning; providing liquidity where they can. They believe they have two tools left 1) to scale and 2) to start buying corporate debt.

Expanded Buyback Program for Government of Canada Bonds

The BoC tells us they see a problem with Government of Canada bonds where illiqidity could have pervasive effects through the financial system. The BoC expanded a program of buybacks and plans to purchase less-widely-traded bond issues from investors while selling more-widely-traded ones in return. Acting as some sort of day trader of treasury bonds:

“Financial institutions may be reluctant to act in their normal role as market makers for bonds and other financial assets. Market makers hold inventories of securities and quote prices at which they will buy and sell—activities that may become prohibitively risky when the prices of these securities are fluctuating widely. Buyers and sellers may then find it difficult to trade—in other words, the market becomes illiquid.”

In today’s press conference when grilled about why the BoC refuses to call the new program “Quantitative Easing,” they responded with saying they like to call it “LSAP: Large Scale Asset Purchases.” The main talking point on the difference, is a formal announcement with a formal plan. You got it, the BoC is so talented they can trade treasuries on intuition baby!

We don’t know how much net buying this will look like, but we were told they will make the purchases on the following dates:

- A switch buyback operation on Monday, March 30th in the 10-year sector.

- A cash buyback operation on Wednesday, April 1st in the 5-year sector.

- A switch buyback operation on Monday, April 6th in the 30-year sector.

- A cash buyback operation on Wednesday, April 8th in the 2-year sector.

Expanded Purchases of Canada Mortgage Bonds (CMBs)

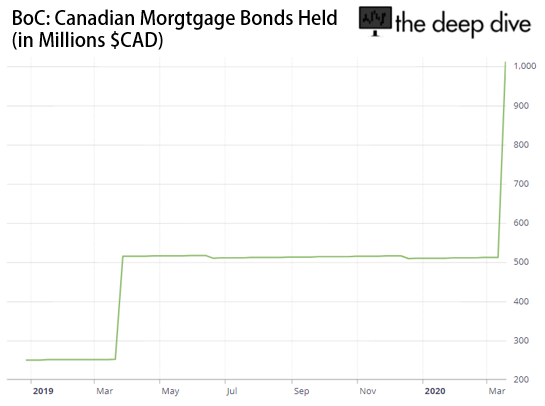

In a program introduced in late 2018, the central bank began purchasing Canada Mortgage Bonds. Banks use CMBs to finance their mortgage lending to Canadian homeowners. Until recently, the BoC has really only made a couple rounds of purchases since introducing the program:

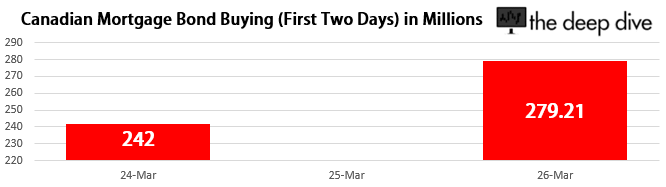

The BoC tell us the functioning of this market was becoming impaired amid broader market turmoil, so they are going to start taking advantage of the previously introduced program to start purchasing mortgage bonds. Their goal is to help provide the means for financial institutions to renew mortgages during this period and support the flow of credit.

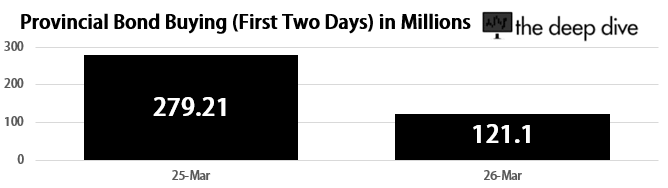

Provincial Money Market Purchase (PMMP)

The Bank also announced a new program to support provincial government funding markets. The Provincial Money Market Purchase (PMMP) program will support a liquid and well-functioning market for short-term provincial borrowing. At the time of publishing, we have seen two days of purchases:

Two More Programs Announced Today!

This morning Poloz announced in his press conference the BoC will begin two new programs: 1) the Commercial Paper Purchase Program (CPPP) to offer short-term funding for businesses; and 2) the BoC will begin acquiring treasuries in the secondary market.

Overall Thoughts

The idea gets thrown around that Canada has the best banking system in the world. I challenge readers to try looking into reserve requirements or banking bailouts for a few hours; the system is very opaque with few media types calling them out. In our view, it’s a wormhole that is intentionally left difficult to follow.

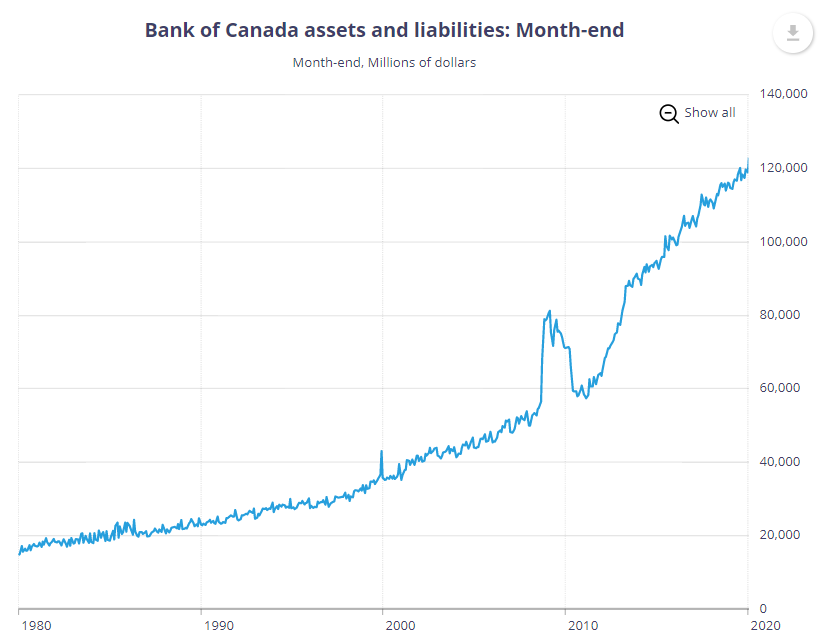

But that’s besides the point. Canada has began quantitative easing measures, or as Poloz like’s to call it: an ‘LSAP – a Large Asset Purchase Program.’ Make no mistake, it’s effectively the same thing. Canada is now purchasing a variety of assets and putting them on the central banks balance sheet.

At the moment, it seems kind of harmless. The BoC is adding less than 1% of the level of mortgages per day than the United States’ Federal Reserve Bank, a country 10x the size. And even with the Provincial Debt purchases, it still isn’t meaningful relative to the size of the balance sheet or overall GDP given what the neighbor to the south is doing.

But make no mistake, it is just the beginning and can add up quickly. The ultimate impact will depend on how deep it goes. If the BoC keeps adding to the money supply to purchase assets for more than a couple of months; this can spin out of control fast.

I’m following something simple: monetary supply (M3). And my strategy; the more M3 grows, the more I will concentrate my efforts on hedging with precious metals. And as for us at the Dive, we will be following the BoC closely for the foreseeable future.

Information for this briefing was found via the Bank of Canada. The author has no securities or affiliations with any of the mentioned securities. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.