Although the Canadian economy has had a strong initial rebound in May and June following the coronavirus outbreak, the Bank of Canada anticipates a full pre-pandemic recovery will take at least another two years.

The full recovery of Canada’s economy will most likely not return until at least 2022, with recuperation occurring in uneven phases across different sectors and provinces. The central bank’s plans to continue buying $5 billion worth of government bonds each week until a prolonged and robust recovery is underway signals that interest rates will remain low for an extended period of time.

Governor Tiff Macklem’s policymakers estimated that Canada’s coronavirus mitigation measures have caused the country’s GDP to fall by 15% in the second quarter, and total supply to decline by 9%; as a result, a substantial gap of 6-7% persists between supply and demand in the economy. Nonetheless, as restrictions continue to be lifted, domestic and foreign demand will increase, thus closing the gap.

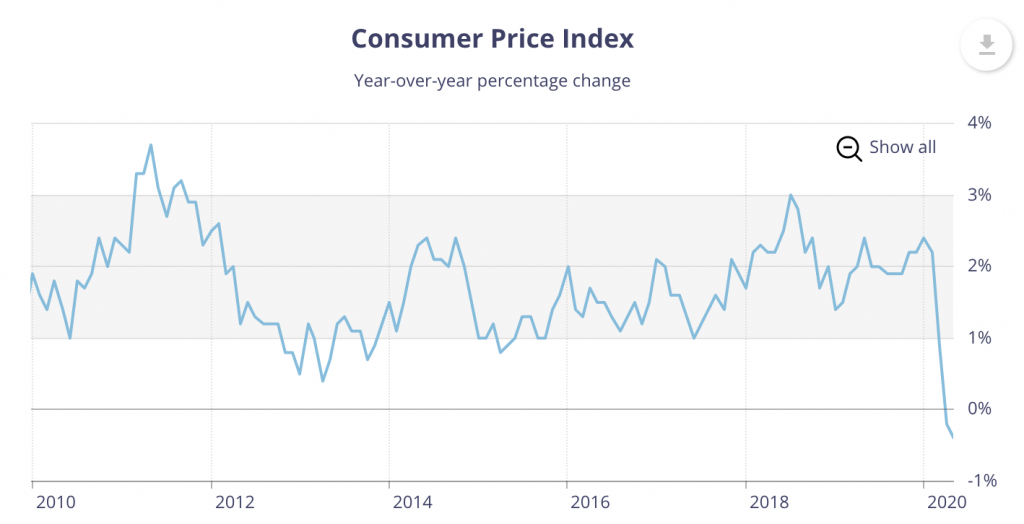

Going forward, the Bank of Canada forecasts a 6.8% GDP decrease in the fourth quarter, and a 7.8% output decline for the 2020 year. A recovery of 5.1% the next year is anticipated, followed by growth of 3.7% in 2022. Simultaneously, inflation will average around 0.6% in 2020, and then increase to 1.2% the following year. An inflation rate of 1.7% is expected in 2022.

Despite a gradual recovery over the next couple of years, the Bank of Canada is warning that there may be permanent scarring effects on the economy stemming from the pandemic. Business investment is expected to remain below pre-pandemic levels even after 2022, and the household savings rate will most likely remain higher compared to previous years. The central bank’s forecasts assume that there will not be a second wave of the virus, and that the pandemic will diminish by 2022.

Information for this briefing was found via Bloomberg and Bank of Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.