As a surprise to markets, the Bank of Canada delivered a slightly smaller rate hike, this time raising borrowing costs 50 basis points whilst warning of a significant deceleration in GDP growth and further increases to the overnight rate as inflation remains persistently high.

The central bank’s overnight rate now sits at 3.75%, marking a 3.5 percentage-point increase from March, when it first began what is turning out to be the fastest tightening cycle in Canadian monetary history. The latest policy decision marks the sixth time the bank increased borrowing costs, but came short of a broader market consensus calling for a 75 basis-point jump. As such, the Canadian dollar slid even further against its US counterpart, to around 1.36.

The Bank of Canada acknowledged domestic and global inflationary pressures remain high, laying the blame on the pandemic recovery, supply chain disruptions, the war in Ukraine— anything but the colossal increase in the money supply over the past two years. Policy makers made note of the recent affects of rising rates, particularly the real estate market which is seeing housing activity sharply decline, and consumers’ and businesses’ spending habits softening.

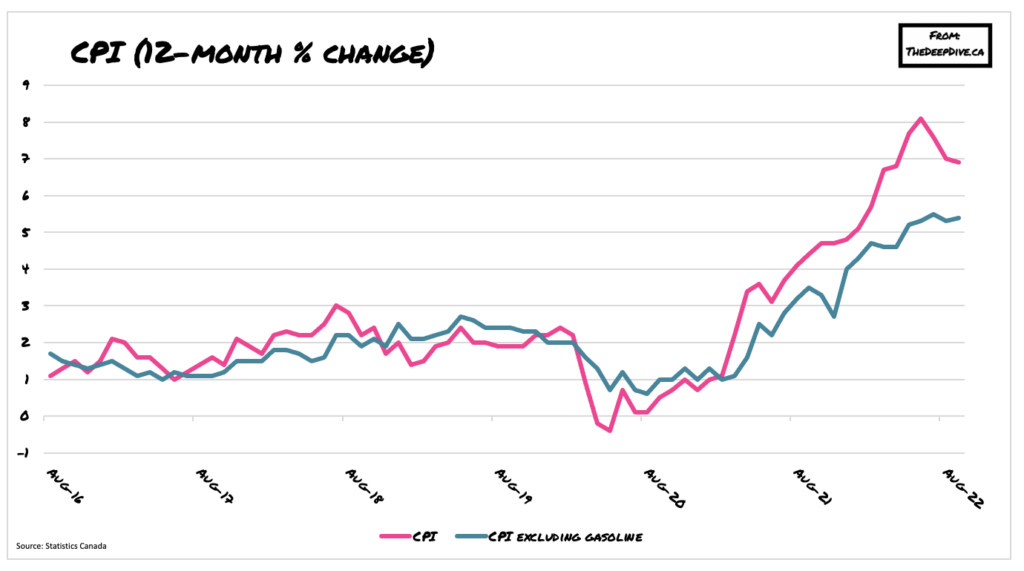

Updated projections are now calling for a significant slowdown in economic growth as the pressure of rising interest rates makes its way through the economy. The bank now anticipates GDP growth will slow from 3.25% in 2022 to less than 1% next year and 2% in 2024. Although inflation slowed from 8.1% to 6.9% in September, the bank’s core inflation measures still remain persistently high, increasing the risk that price pressures become entrenched. The Bank of Canada projects CPI will decline to around 3% by the end of next year, before returning to the 2% target rate by the end of 2024.

Information for this briefing was found via the BOC and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.