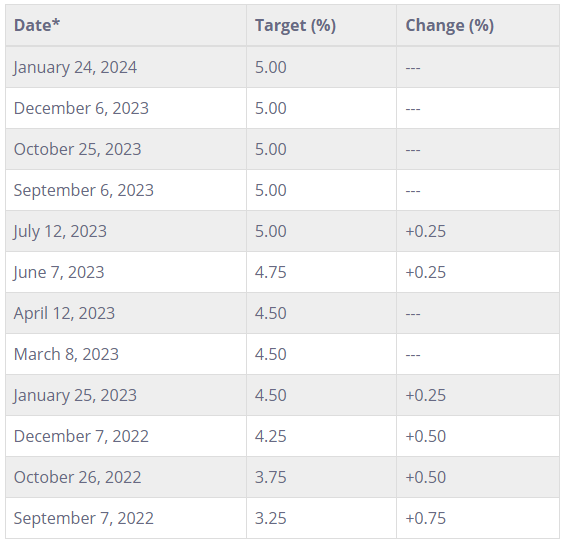

The Bank of Canada has maintained its overnight rate at 5%, continuing its quantitative tightening strategy amid global economic deceleration. The U.S. and euro area are seeing slower growth, while China’s activity is restrained by low consumer confidence and policy uncertainty. Oil prices are notably lower than previous forecasts.

Global GDP growth is now projected at 2.5% in 2024 and 2.75% in 2025 as per the Bank, with inflation expected to align with central bank targets by 2025. In Canada, economic stagnation since mid-2023 is likely to persist into early 2024, impacted by high prices and interest rates. Consumer spending has reduced, and business investment declined, although wage growth remains around 4% to 5%.

The Bank anticipates economic recovery from mid-2024, spurred by household spending, exports, and business investment, with government spending also contributing. The Bank forecasts GDP growth of 0.8% in 2024 and 2.4% in 2025.

Canada’s CPI inflation closed the year at 3.4%, with shelter costs continuing as the primary contributor to above-target inflation. The Bank forecasts inflation to hover around 3% in the first half of this year and then gradually decrease, reaching the 2% target by 2025. Despite a slowdown in demand easing price pressures, core inflation measures are yet to show consistent declines.

Information for this story was found via the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.