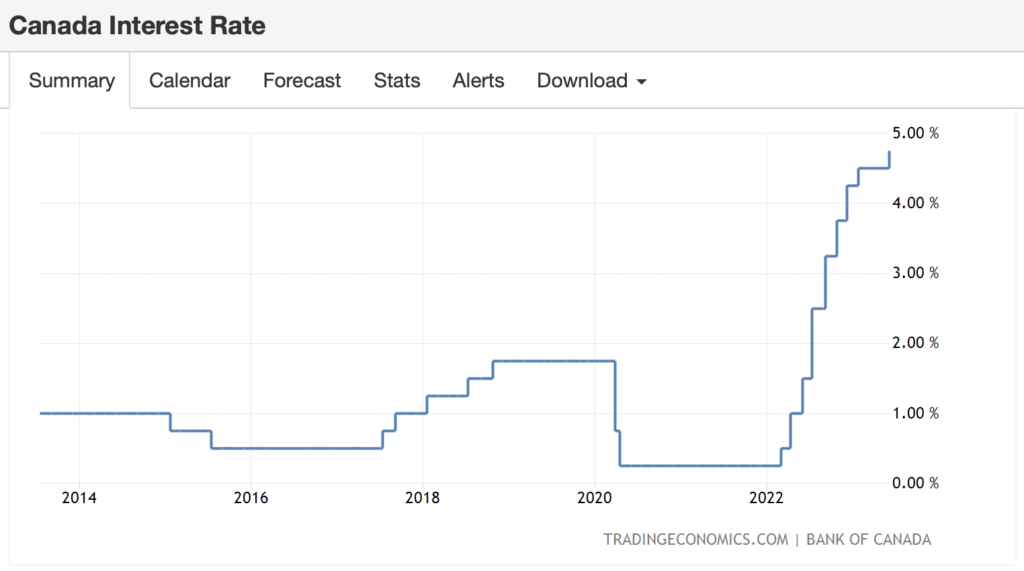

The Bank of Canada is set to increase interest rates this week, indicating its commitment to addressing inflation amid a resilient economy.

Scheduled for Wednesday, the interest rate announcement follows a recent quarter-point hike, bringing the key rate to 4.75%. The decision in June marked the end of the central bank’s pause on rate increases, prompted by concerns that rates were insufficient to restore inflation to its desired two percent target.

According to Dawn Desjardins, Chief Economist at Deloitte, while some indicators suggest a shift in the economy, it may not be significant enough to sway the Bank of Canada’s decision. Recent reports show rising unemployment rates and a slowdown in wage growth, yet inflation remains stubborn, with high wage growth and an active economy.

“I do think that we are seeing things shift. Are they shifting fast enough for the Bank of Canada? Perhaps not,” Desjardins said.

Interest rates have reached their highest point in 22 years, reflecting policymakers’ belief that previous monetary measures were insufficient in reestablishing equilibrium between supply and demand and achieving sustainable 2% inflation.

The Bank of Canada has refrained from providing explicit guidance to financial markets, opting instead to base its decisions on incoming economic data. One key area of focus has been the labor market, where the central bank has warned that current annual wage growth, ranging from four to five percent, is incompatible with its inflation target without productivity gains.

Economists analyzing the latest job report for June present a mixed picture. The addition of 60,000 jobs indicates sustained hiring activity, while a higher unemployment rate of 5.4% suggests an increase in job seekers as the population continues to grow.

Wage growth also experienced a notable slowdown to 4.2% last month compared to May’s year-over-year gain of 5.1%.

The Bank of Canada’s recent business outlook survey indicates that businesses expect slower wage growth in the coming year, a notable change since the beginning of the pandemic. However, despite these factors, Desjardins’ senior director of Canadian economics Randall Bartlett suggests that the labor market remains tight, with underlying strength evident despite the approaching five percent overnight rate.

“We are still seeing a lot of underlying strength in the in the Canadian labour market, and much more so than you would expect with the overnight rate approaching five per cent,” he quipped.

In terms of inflation, price growth has slowed since last year, with May’s inflation rate at 3.4% compared to a peak of 8.1% in the summer. However, much of this deceleration can be attributed to lower energy prices, while other prices continue to rise. Core inflation, which excludes volatile components, actually accelerated in May.

The Bank of Canada, along with private-sector economists, faces the challenge of bringing inflation back to the target of two percent. Despite expectations of a recession in late 2022, the economy has continued to expand even with interest rates at their highest levels in decades. This justifies the Bank of Canada’s hawkish approach, according to Bartlett, who believes they are paving the way to sustainably bring inflation closer to the target.

Preliminary estimates from Statistics Canada suggest further economic growth in May following a flat performance in April. Bartlett’s firm estimates growth in the second quarter at twice the pace forecasted by the Bank of Canada in April.

Consequently, economists anticipate not only a rate hike but also a signal that more increases may follow if the economy does not slow down sufficiently.

Information for this briefing was found via Toronto Sun. The author has no securities or affiliations related to these organizations. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.