Canada’s central bank is expected to raise interest rates once again during its upcoming policy meeting this week in response to the highest inflation in decades.

After keeping borrowing costs at near-zero for the past two years in an effort to stimulate economic activity amid the Covid-19 pandemic, the Bank of Canada is now attempting to expeditiously reign in runaway consumer prices and withdrawal monetary support. So far, policy makers led by Governor Tiff Macklem have raised borrowing costs in the last two consecutive policy meetings, with yet another scheduled hike on Wednesday. This time, however, markets and economists are anticipating a second 50 basis point rate hike— an unusually aggressive move that would bring borrowing costs to 1.5%.

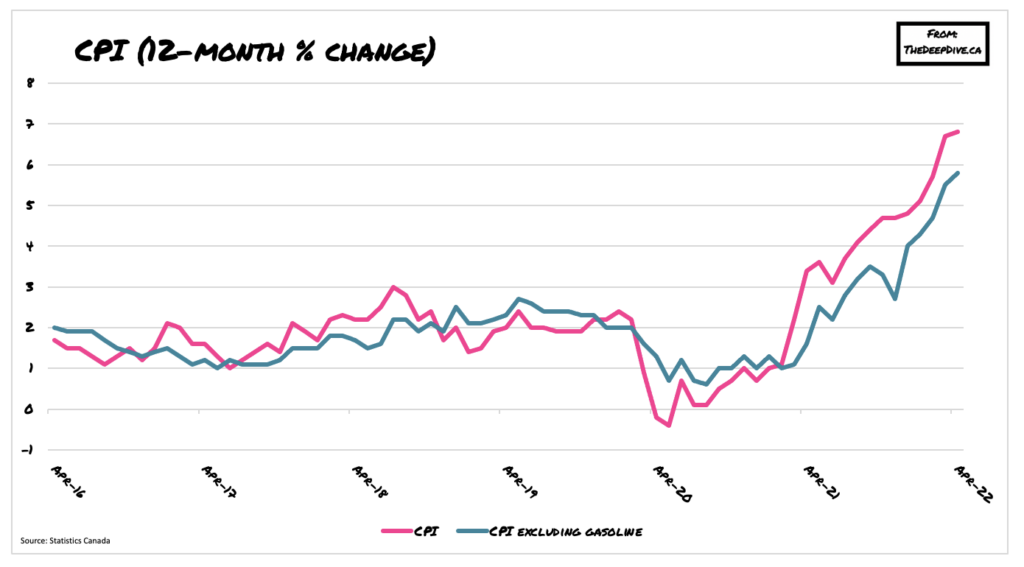

Compared to historical standards, such a hawkish succession in monetary policy tightening certainly appears extraordinary— in fact, the last time the Bank of Canada announced a half percentage point increase was over 20 years ago, instead opting to move in 25 basis-point increments. But, Macklem is beginning to finally feel the heat of rapidly accelerating inflation, which just last month hit 6.8%— substantially above the central bank’s 2% target rate.

“We are confronted with an economy that is showing clear signs of overheating, very tight labour markets and this perfect inflationary storm of global events and preference shifts [in consumer spending],” said Bank of Canada deputy governor Toni Gravelle earlier this month in a speech. “Simply put, with demand running ahead of the economy’s capacity, we need higher interest rates to cool domestic inflation.”

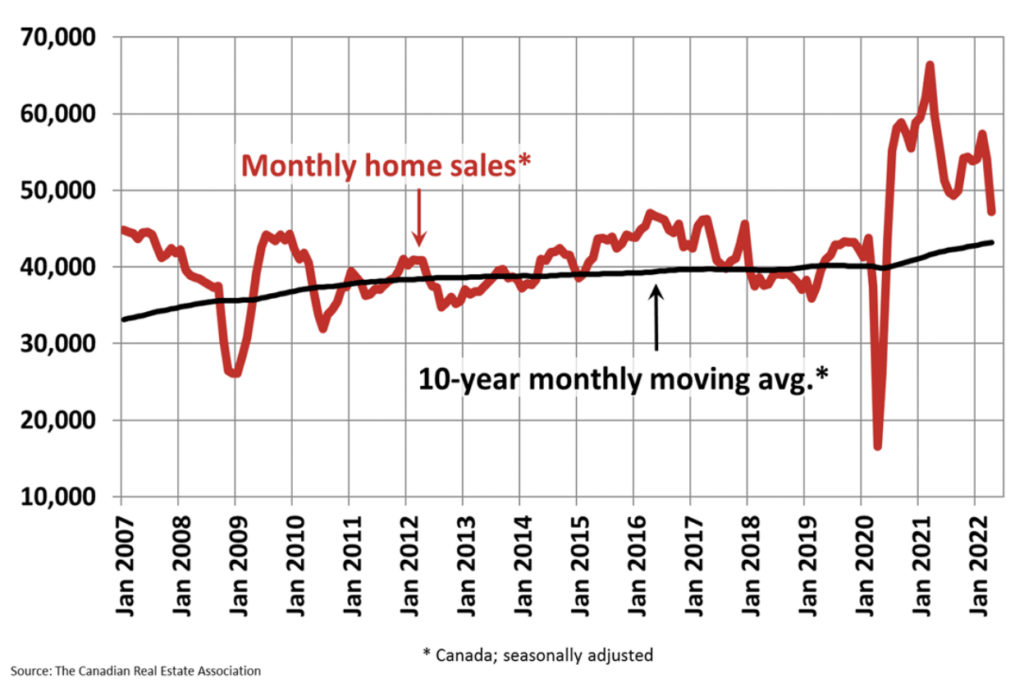

Still, raising interest rates in an effort to cool inflation comes with its own set of drawbacks, namely being the subsequent negative effect on Canada’s housing market. Latest data from the Canadian Real Estate Association showed that home sales fell 12.6% month-over-month in April while prices were down 0.6%, as markets cool off in response to rising mortgage costs.

During his speech, Gravelle warned that rising interest rates could have a substantially more grave impact on household finances compared to previous tightening cycles because debt-servicing costs are going to be a lot higher, subsequently reducing consumer spending more aggressively than they otherwise would. But, should the central bank spend “too much time focusing on the headwinds facing the economy (slower housing activity, crumbling consumer confidence), markets may come to believe that the bank is unwilling to bring inflation under control, causing inflation expectations to become unanchored and requiring a more painful tightening cycle,” cautioned TD chief strategist Andrew Kelvin.

Information for this briefing was found via Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.