The Bank of Canada released its business outlook survey for the third quarter on Monday, saying that overall business confidence has softened. Many of the firms surveyed expect slower sales growth as rising interest rates continue to stunt demand growth. Though the survey notes that businesses are seeing early signs that pressures on prices and wages have started to ease, inflation expectations continue to remain high.

According to Reuters, traders expect that the Bank of Canada will leave 2022 with interest rates at or around 4%, meaning that between the next two meetings, they expect the central nank to raise 75 basis points.

The business outlook survey comprises firms that are “in accordance with the composition of the country’s gross domestic product.” The participants are surveyed on their demand and capacity pressures and asked to provide forward-looking views on their business activity.

The survey shows that businesses believe their conditions have worsened over the summer, with only 25% of the businesses reporting a positive outlook for their business; this is compared to 49% in August and 58% in July.

On a more positive note, the survey reveals that businesses’ expectations for inflation over the short term has trended downwards to 4.95% in one year’s time. However, this is still above the Bank of Canada’s target. It is also noted that the participant’s inflation expectations for the medium term have dropped down to 2.42% inflation in 5 years.

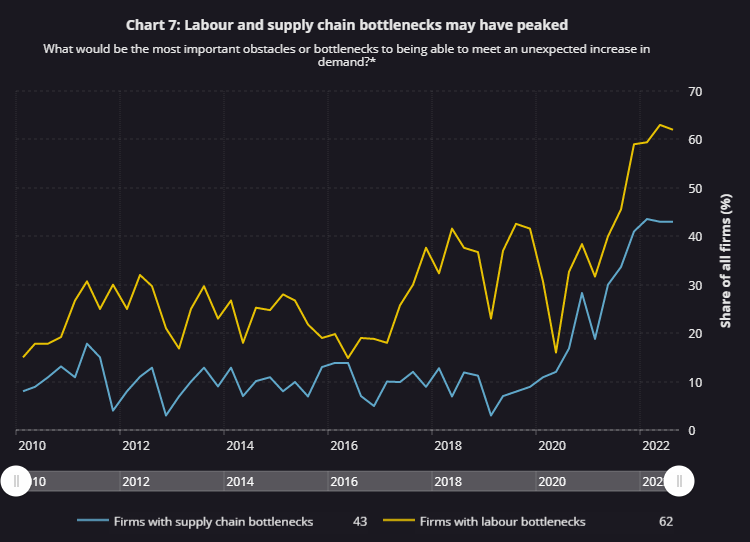

The participants say that factors affecting their inflation gauge include elevated commodity prices often tied to the ongoing war in Ukraine, persistent supply chain issues, and high labor costs.

Another positive note that came out of the survey is that although firms continue to see capacity pressures due to labor constraints and supply chain issues, there are signs that these pressures are easing. The survey shows, “For the first time in the past five quarters, businesses reported that their supply chains had improved compared with three months ago.”

The survey results show that firms expect slower sales growth over the next 12 months, while several firms have noted that their future sales indicators have worsened compared to a year ago.

Lastly, the survey participants were asked about the chance that the Canadian economy will be in a recession within the next 12 months. Over 50% of the participants believe that the Canadian economy will be in a recession but believe that it will only affect companies that are linked to housing activity and other household consumption.

When asked what would lead to a recession, participants said the leading reason would be large increases in interest rates and high prices which would reduce consumption.

Information for this briefing was found via the Bank of Canada and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.