Bed Bath & Beyond (NASDAQ: BBBY) is apparently looking to scorn its investors this morning, revealing it is seeking approval from shareholders to proceed with a reverse share split.

“We are seeking shareholder approval for a reverse stock split to continue raising the necessary capital to fulfill our business goals. We understand the choices we have had to make to improve our liquidity have led to speculation both about our business and our stock. We are taking the necessary steps as part of our financial strategy to sustain and grow our business,” commented CEO Sue Gove in a filing made this morning by the company.

READ: BBBY: Bed Bath & Beyond To Shutter Canadian Operations After Filing For Creditor Protection

In a filing made last week related to its upcoming Special Meeting of Shareholders, which is to be held May 9, the company indicated it intends to conduct a reverse stock split at a ratio between 1 for 10 and for 20, with the final ratio used to be at the discretion of the firms board. As of March 27 there were 428.1 million shares of Bed Bath & Beyond outstanding, meaning after the reverse split the company will have anywhere from 21.4 million to 42.8 million shares outstanding.

“We recognize this past year has been among the most difficult in our Company’s history. Particularly over the last several months, we are grateful to have overcome immediate challenges and impediments again and again thanks to the support of our customers, Associates, business partners, and shareholders,” added Gove.

The firm this morning also commented on several inquiries it has received related to “naked short selling,” indicating it has no specific access to information related to share lending or short selling, while at the same time denouncing any market manipulation of its stock.

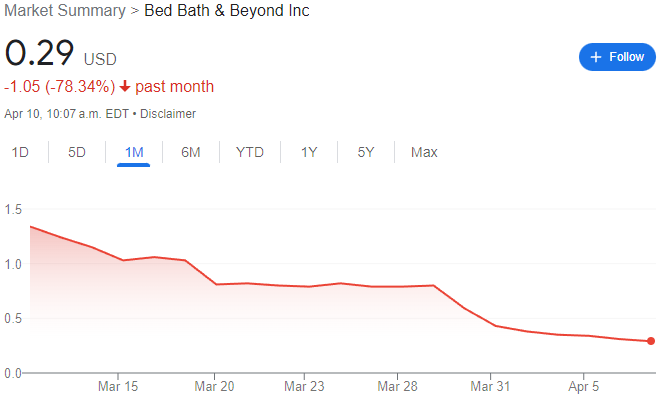

Bed Bath & Beyond last traded at $0.29 on the Nasdaq.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.