Finance Minister Chrystia Freeland will release Canada’s federal budget plan on March 28, and numerous rumors have been told about what it will include, including expected tax rate increases.

For one, Twitter user Global Macro said tax accountants they have spoken to have indicated that top tax rate could be expected to increase to 58% in Ontario and 58.5% in British Columbia.

Tax update – Canada. Tax accountants/ lawyers I have spoken to this wk. Feds in their budget next week likely to increase top tax rate to 58% Ont + 58,5% BC. One time strip of corp at 26% in question. Dozens rushing to strip. Liberals never disappoint – Tax a National Sport.

— Global Macro (@FinEconGlobal) March 18, 2023

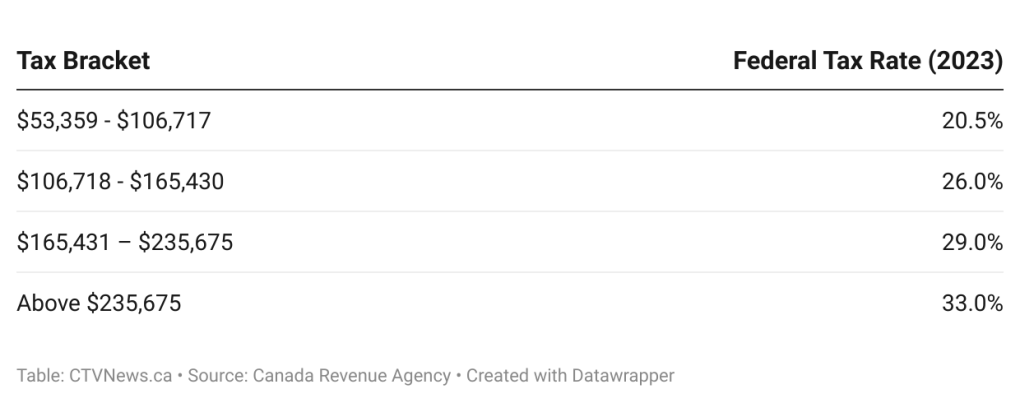

In Ontario, income tax rates range from 5.05% to 13.16%, with a combined federal and provincial tax rate of 20.05% to 53.53%. The highest combined BC tax bracket is 53.50% on all earnings exceeding $222,420.

The top federal tax rate of 33% currently kicks in at an income of more than $235,675 for 2023, which is a 6.3 percent increase over 2022 due to the strong inflation we’ve seen over the past year. The New Democratic Party’s pre-election agenda aimed to raise the top rate by two percentage points to 35%. If passed, this would raise the top total marginal tax rate, after provincial taxes, to almost 56% in British Columbia, Ontario, Quebec, and Nova Scotia, and 57% in Newfoundland and Labrador.

Some analysts are analyzing the Standing Committee on Finance’s 226-page pre-budget Report, which contains 230 specific suggestions for tax adjustments and spending, for clues.

Among the proposal: “Undertake a public review to identify federal tax expenditures, tax loopholes and other tax avoidance mechanisms that particularly benefit high-income individuals, wealthy individuals and large corporations and make recommendations to eliminate or limit them.”

Observers are taking this as a sign that there will be major tax changes for high-income individuals. The measure may cover surplus income and capital gains, among others.

The government may decide to discontinue a popular private corporation tax-planning arrangement that some sophisticated taxpayers have been using to distribute corporate surplus (essentially, retained earnings for tax purposes) from their corporation at capital gains rates, rather than the higher rates for Canadian dividends, or through the payment of a salary or bonus.

The Canada Revenue Agency has previously attempted to challenge surplus strip transactions, but courts have generally held that this type of planning is acceptable and does not violate the general anti-avoidance rule, because the Income Tax Act does not contain a general policy requiring shareholders to remove their surplus through dividends rather than capital gains.

The NDP is also proposing a hike to 75% on the capital gains inclusion rate, which is currently set at 50%.

Canada adjusts the federal income tax bands slightly each year to account for inflation. These tax rates, as well as other benefits, tax credits, and payments, are linked to the rate of inflation. When inflation rose considerably in 2022, the tax bands underwent significant modifications and were raised by 6.3% for 2023.

Information for this briefing was found via Financial Post, CTV News, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.