In a landmark step for the United States and its US$3-trillion cryptocurrency industry, President Joe Biden is expected to sign an executive order today outlining marching orders for relevant agencies to come up with a regulatory policy on digital assets.

The White House released a statement today on what would the executive order contain, saying it would be the “first-ever, whole-of-government approach to addressing the risks and harnessing the potential benefits of digital assets and their underlying technology”.

The order prioritizes consumer and investor protection, financial stability, and illicit finance mitigation. The US Treasury Department and other relevant government agencies are being directed “to assess and develop policy recommendations,” as well as encouraging regulators “to ensure sufficient oversight and safeguard against any systemic financial risks.”

In July 2021, US Senator Elizabeth Warren demanded Securities and Exchange Commission Chairman Gary Gensler to determine the agency’s role in regulating cryptocurrencies. Acknowledging Warren’s point on lack of protection for digital asset investors, Gensler responded by asking Congress for additional authority to keep crypto “from falling between the regulatory cracks.”

Today, @POTUS signed an Executive Order on crypto-assets. I look forward to collaborating with colleagues across the government to achieve important public policy goals: protecting investors & consumers, guarding against illicit activity, & helping ensure financial stability.

— Gary Gensler (@GaryGensler) March 9, 2022

The order also calls the Financial Stability Oversight Council, chaired by US Treasury Secretary Janet Yellen, “to identify and mitigate economy-wide financial risks… and develop appropriate policy recommendations to address any regulatory gaps”. Further, all relevant agencies are being tasked to coordinate to mitigate the risk “posed by the illicit use of digital assets”.

Crypto’s market cap jumped 6.5% today, with bitcoin leading the rally to its US$42,000-mark, after the Treasury Department prematurely published a statement on the details of the executive order. Regulation measures on digital assets have been discussed over months in the cryptosphere as Washington DC tries to muster a framework. The soaring price of cryptocurrencies after the details of the executive order was leaked seems to be a response of quelled fear on the part of the investors.

Biden also included in the order an attempt to explore a U.S. Central Bank Digital Currency (CBDC), a digital form of a country’s sovereign currency. The order directs the government agencies to “assess the technological infrastructure and capacity needs” and the Federal Reserve “to continue its research, development, and assessment efforts”.

This is not technically news. In October 2021, the Biden administration already said it is mulling over imposing bank-like regulation on stablecoins. This includes ordering issuing firms to identify as banks. What’s left to figure out is how would a US CBDC play out with existing digital currencies in the market.

According to United Nations International Telecommunication Union, 68 central banks around the world have announced they are investigating the prospect of a CBDCs, while 28 have already launched their pilot CBDCs.

ok so one thing that confuses me–

— SBF (@SBF_FTX) March 9, 2022

this was *always* going to be what the EO said; every sign pointed to it

why did markets go down when it was formally announced that it would come out this week (it was already going to come out?), and why did they go up when it did come out?

Also, in a true United States fashion, the executive order also indicated the desire to “reinforce US leadership in the global financial system” with the new currency. Biden is directing the Commerce Department “to drive US competitiveness and leadership in and leveraging of digital asset technologies”.

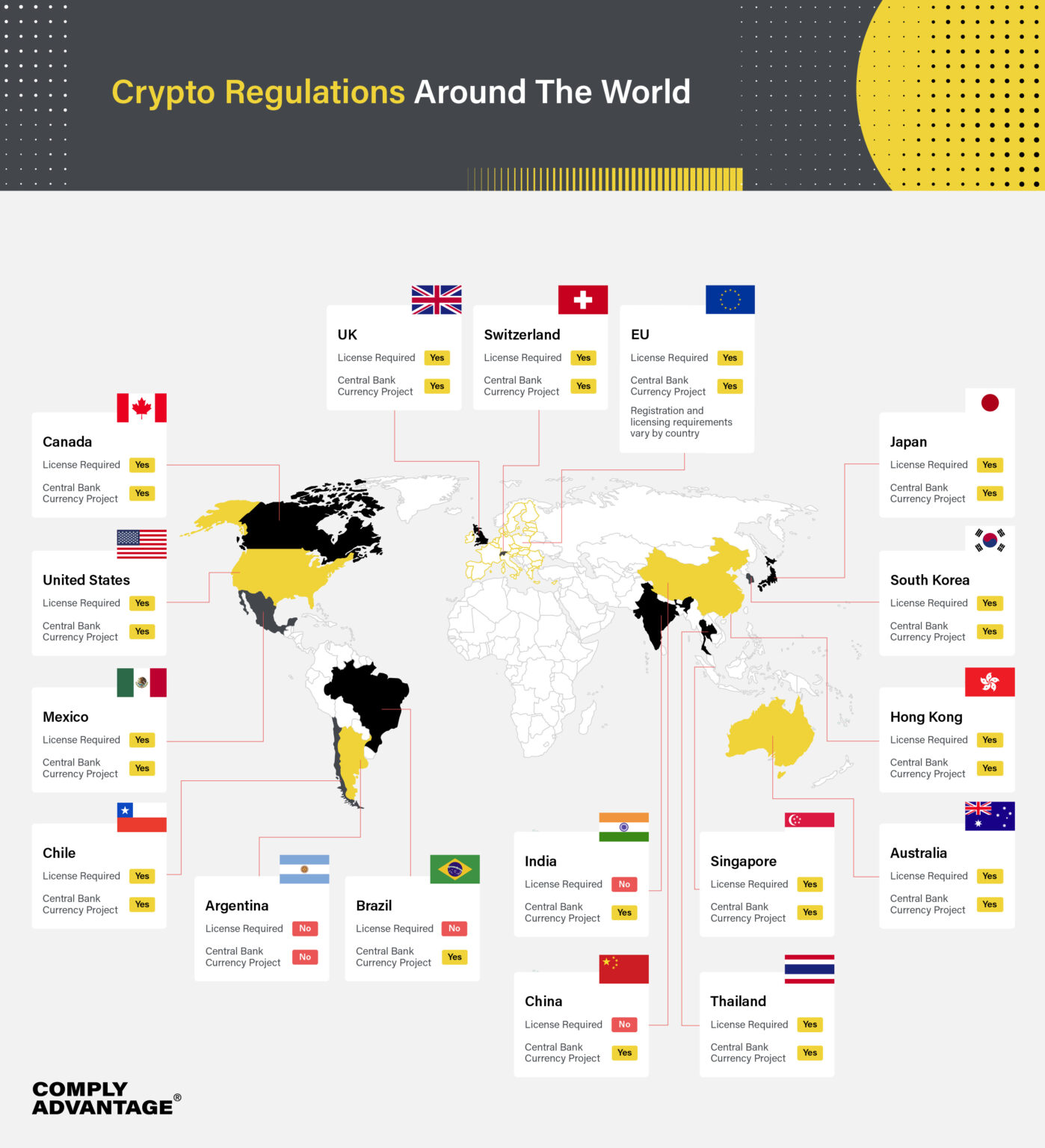

The US joins the growing list of countries that have installed regulatory frameworks on their respective cryptocurrency industries. Singapore’s Payment Services Act 2019 instituted its Monetary Authority to regulate crypto exchanges and businesses while South Korea mandates the Financial Supervisory Service to oversee regulation on digital assets.

Information for this briefing was found via CNBC and Comply Advantage. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.