Binance has recently made subtle changes to its Terms of Service, leaving users potentially affected by the modifications unaware. The revisions primarily revolve around the handling of digital assets that are no longer listed on the platform.

Under the updated terms, Binance now possesses exclusive authority to determine the digital assets available on its platform, granting them the right to add or remove assets at their discretion.

Binance updated its TOS (https://t.co/d71A8zwBOP) within the past week to say that it might "in its discretion convert such Digital Assets [that it's delisted] to a different type of Digital Asset." pic.twitter.com/J0FTQGssi0

— Jay Pinho (@jaypinho) June 10, 2023

While such practices are common among exchanges, the new terms take it a step further. If a user retains a delisted digital asset in their Binance account beyond a specified period, Binance reserves the right to convert these assets into a different type of digital asset, chosen solely by the exchange.

The revised terms have implications for users who hold delisted cryptocurrencies, as the exchange now has the authority to convert these assets into a different cryptocurrency at its discretion.

The implications of this policy change are significant. Binance is not obligated to provide advance notification of these conversions, and it absolves itself of any liability associated with them. Furthermore, the updated terms mention that Binance may alter the order size available for each digital asset.

These modifications have raised concerns among users, as some speculate that delisted cryptocurrencies could potentially be converted into Binance’s native token, BNB. While this remains speculative, the lack of transparency regarding the type of digital asset Binance might convert to has fueled these apprehensions.

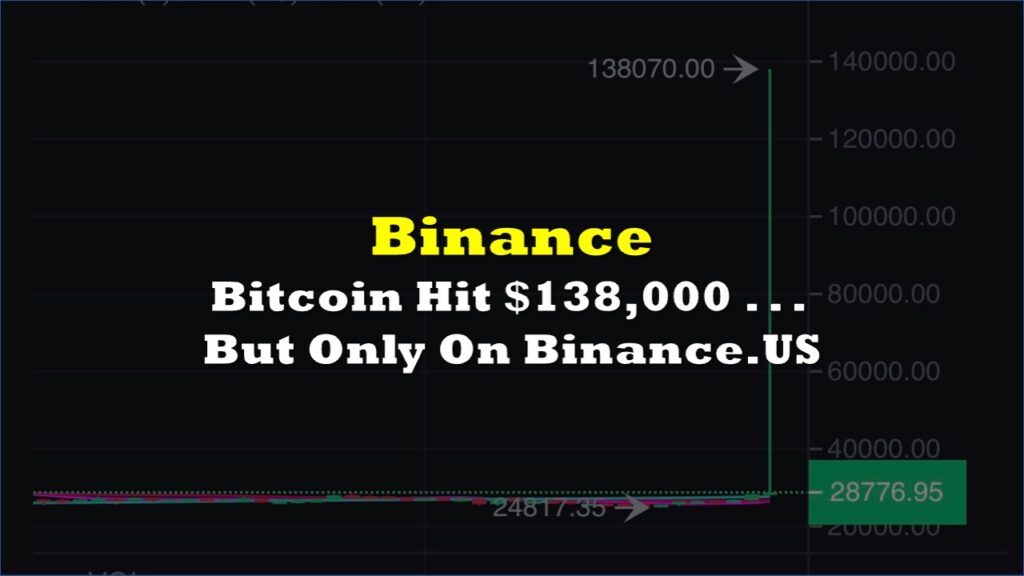

🚨BINANCE ALERT🚨$BNB is diving off a cliff. 🩸🩸🩸 pic.twitter.com/cpGQh7Q78j

— Parrot Capital 🦜(Read the pinned 🧵) (@ParrotCapital) June 12, 2023

These amendments to Binance’s Terms of Service come in the wake of the Securities and Exchange Commission (SEC) filing a lawsuit against Binance US for operating as an unauthorized exchange within the country.

Binance.US, the supposedly American unit of the world’s largest cryptocurrency exchange, announced that as of June 13, U.S. dollar deposits will be suspended, and the exchange’s banking partners are preparing to pause fiat dollar withdrawal channels.

Taking it to Twitter, Binance.US revealed that it is taking “proactive steps” in its transition to becoming a crypto-only exchange, temporarily. However, the exchange assured its customers that trading, staking, as well as deposits and withdrawals in cryptocurrencies, will remain fully operational.

“As a result, in an effort to protect our customers and platform, today we are suspending USD deposits and notifying customers that our banking partners are preparing to pause fiat (USD) withdrawal channels as early as June 13, 2023. We encourage customers to take appropriate action with their USD,” the firm said in a tweet.

Binance.US made its stance clear in a tweet, describing the SEC’s approach to cryptocurrency as “extremely aggressive and intimidating.” The exchange vowed to vigorously defend itself, its customers, and the industry against what it deems as “meritless attacks” by the SEC.

“The SEC has taken to using extremely aggressive and intimidating tactics in its pursuit of an ideological campaign against the American digital asset industry. Binance.US and our business partners have not been spared in the use of these tactics, which has created challenges for the banks with whom we work,” Binance added.

In the aftermath of the lawsuits, the crypto industry has been highly critical of SEC Chair Gary Gensler. However, Gensler has refuted claims that the agency is attempting to crush the crypto industry, despite the ongoing regulatory scrutiny.

As the crypto community braces itself for further developments, one thing remains certain: the landscape of the cryptocurrency market is changing, and the consequences of these legal battles are yet to fully unfold.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.