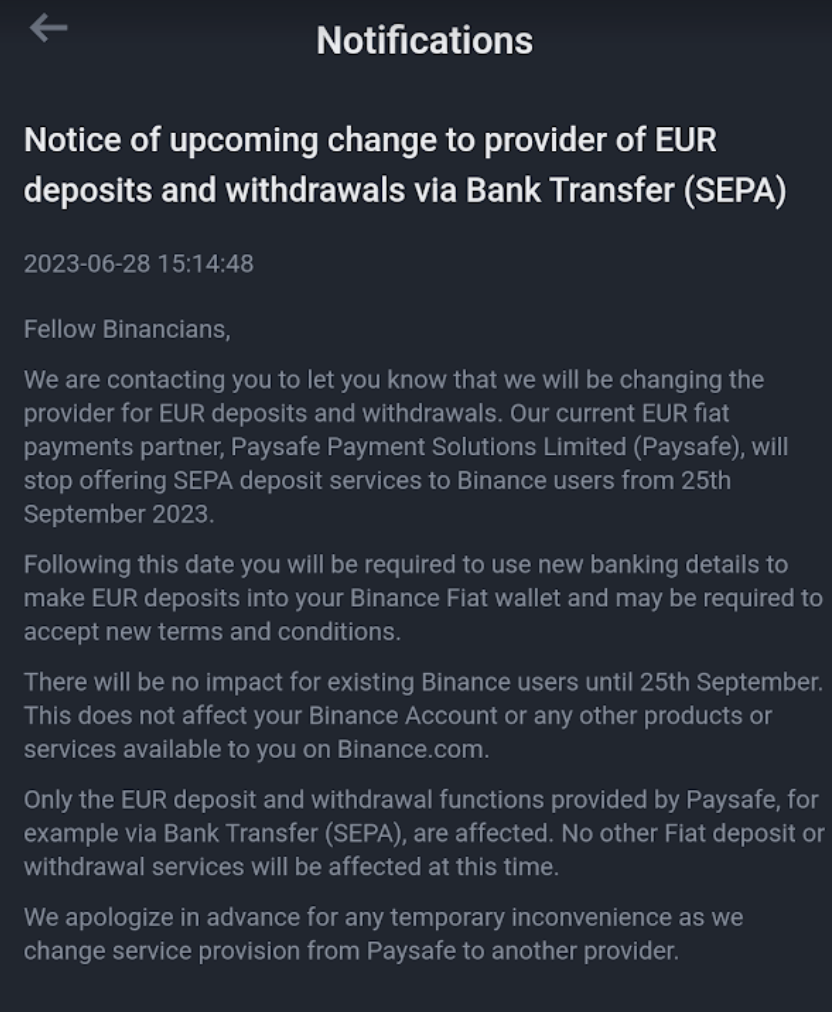

Paysafe Payment Solutions, the European banking partner of cryptocurrency exchange Binance, has announced that it will no longer offer its embedded wallet solution to Binance across the European Economic Area (EEA) starting from September 25th. The decision comes as Paysafe and Binance work together to implement a fair and orderly process for terminating the service over the next few months.

“Following a strategic review, we have taken the decision to cease offering our embedded wallet solution to Binance across the region,” Paysafe said in an email. “Paysafe and Binance are now working to mutually implement an orderly and fair process to terminate this service over the next few months.”

Binance has confirmed the news and stated that it will be changing its banking provider for euro deposits and withdrawals through the Single Euro Payments Area (SEPA). However, no details about the new partner have been revealed yet.

Binance intends to provide more information in due course, according to a company spokesperson. On a typical basis, Binance accesses SEPA through payment intermediaries.

Despite the change, all other methods of depositing and withdrawing fiat currencies, as well as buying and selling cryptocurrencies on Binance.com, will remain unaffected during this transition period, as stated by the spokesperson.

Paysafe’s decision to end its support for Binance comes at a time when the cryptocurrency exchange is facing increased scrutiny from regulators, particularly in relation to anti-money laundering measures.

Earlier this month, Binance and its U.S. affiliate entered into an agreement with the Securities and Exchange Commission (SEC) to ensure that U.S. customer assets remain within the country until a lawsuit filed by the regulatory agency is resolved.

Last year, Binance partnered with Paysafe to allow its users to deposit sterling via Faster Payments, a network overseeing payments and bank account transfers in the UK. However, Paysafe is now in the process of withdrawing this service in the UK as well.

As Binance continues to face regulatory challenges in Europe and the U.S., it has announced its retreat from the Netherlands and Cyprus, requested the cancellation of permissions in the UK, and been ordered to cease offering crypto services in Belgium.

European Union authorities have also flagged Binance’s operations in Ireland and Malta, expressing concerns about potential illicit activities such as money laundering and tax evasion. Investigators suspect Binance of obfuscating its accounts and operations across various EU jurisdictions, commingling funds from different countries to evade scrutiny from regulators and tax authorities.

The company has also faced setbacks in Germany, as the country’s financial watchdog, the Federal Financial Supervisory Authority (BaFin), has reportedly decided not to grant Binance a custody license.

Binance has expressed its commitment to complying with BaFin’s requirements and stated that it is confident in its ability to continue discussions with regulators in Germany.

“While we are unable to share details of conversations with regulators, we continue to work to comply with BaFin‘s requirements. As expected, this is a detailed and ongoing process. We are confident that we have the right team and measures in place to continue our discussions with regulators in Germany,” a Binance spokesperson said in a statement.

The company has faced difficulties in gaining regulatory approval in various European countries, including Austria and Cyprus, and has withdrawn its applications in those jurisdictions.

Binance has stated that it is streamlining its European strategy in preparation for the new crypto regulations in the European Union, which will enable crypto firms to operate across the single market by obtaining regulatory approval in one of the member states.

But Binance’s regulatory issue in the United States has spread to its international markets, particularly in Europe, leading to the departure of several prominent European managers, including key members of the German-speaking team.

Information for this briefing was found via Reuters, CoinDesk, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.