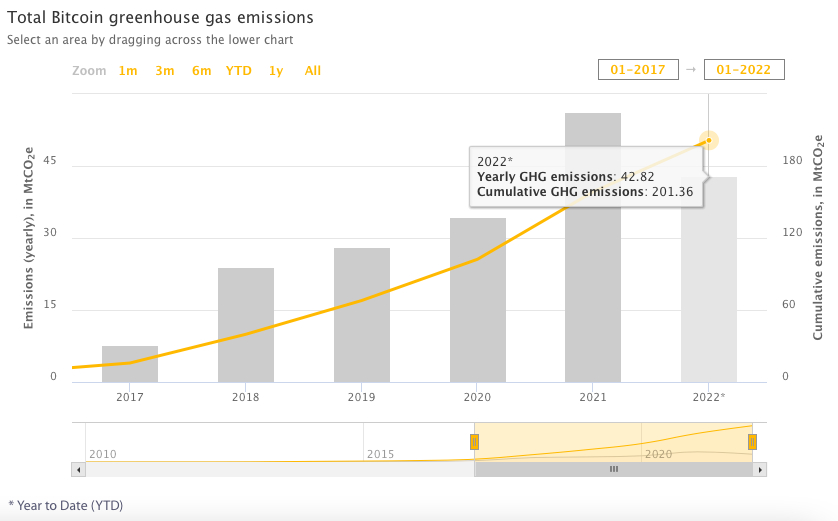

Bitcoin miners have emitted about 200 million tonnes of CO2 in the cryptocurrency’s short history, according to experts at the University of Cambridge.

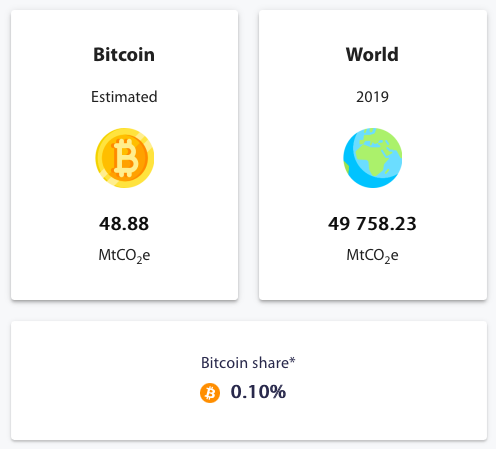

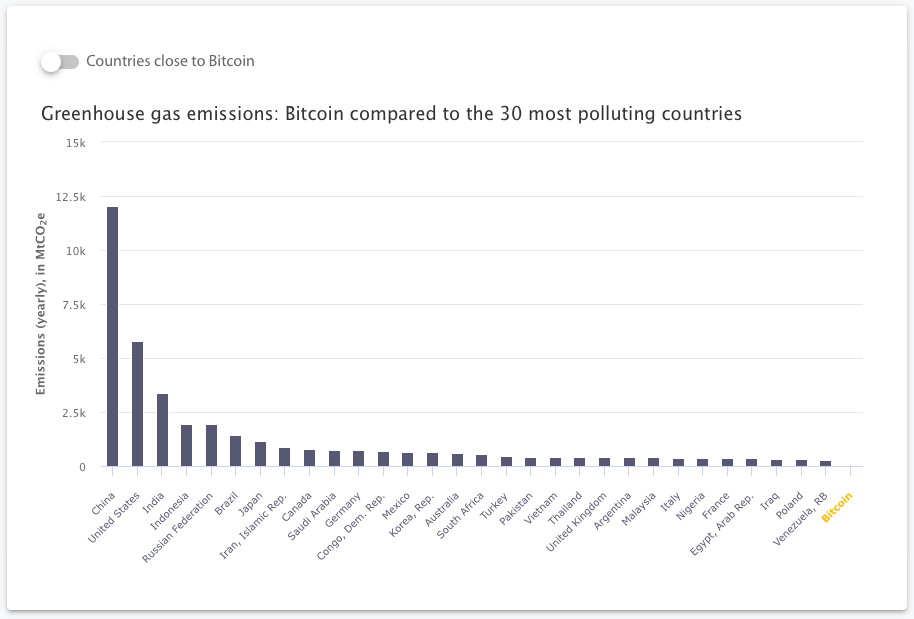

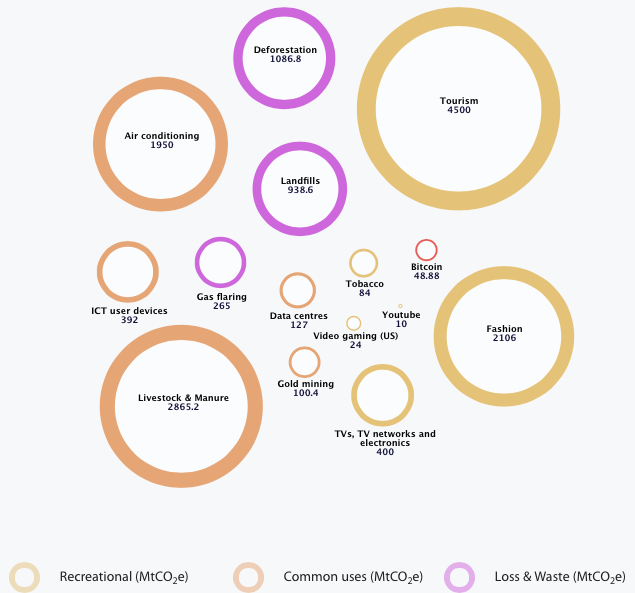

According to the data presented by the university’s Cambridge Bitcoin Electricity Consumption Index (CBECI), bitcoin mining has breached the 200 million tonne-mark this year on its cumulative greenhouse gas emissions. The research body estimates that the digital asset emits around 48.88 million tonnes of CO2 annually, roughly 0.10% of the world’s emissions.

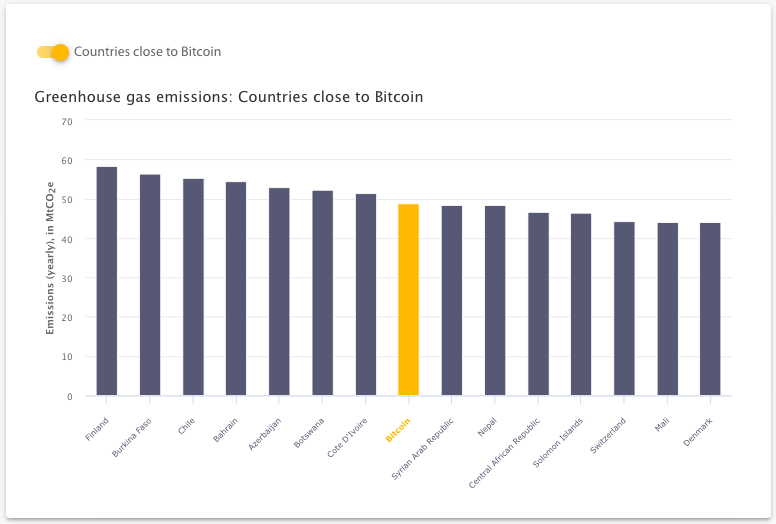

Bitcoin mining, on annual average, emits more carbon than the countries of Syria, Nepal, Switzerland, and Denmark. Although comparing with the rest of the carbon-emitting countries in the world, the crypto asset ranks 88th.

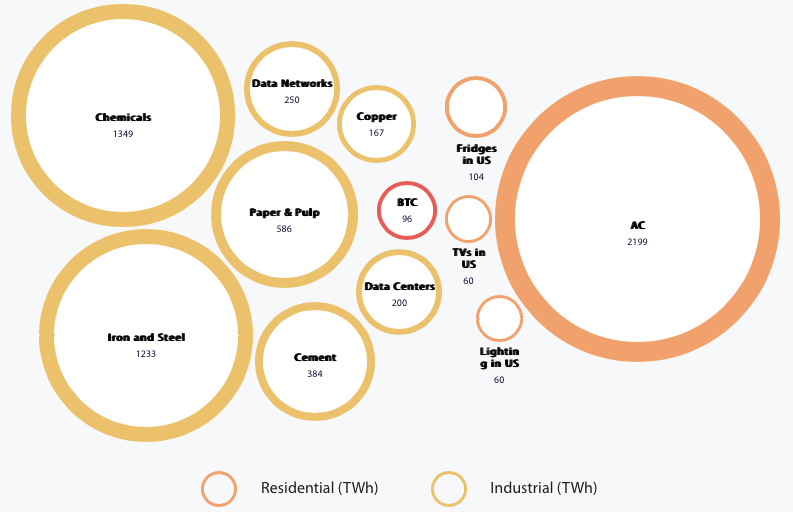

Comparing to the annual carbon emissions of other industries, bitcoin mining emits half of what gold mining and double of what video gaming in the US produces.

In terms of energy consumption sources, bitcoin mining still gets more than half of its electricity from coal and gas sources. The crypto space has also seen a decline in sourcing its energy from renewables.

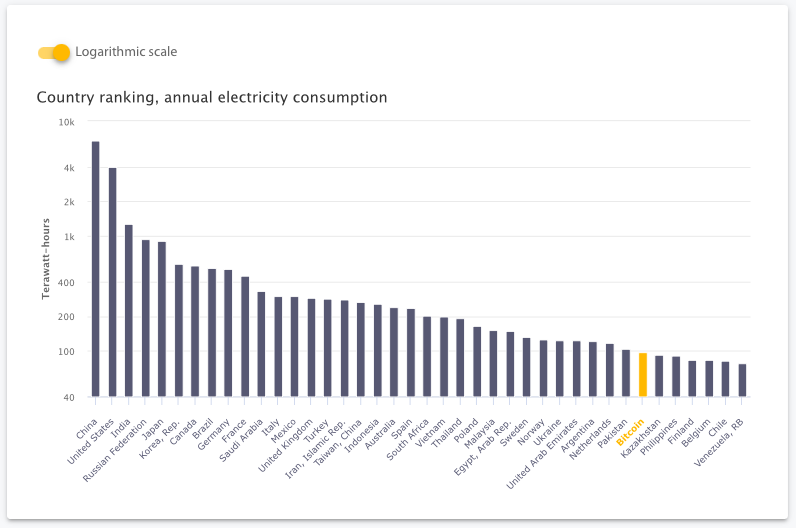

Bitcoin mining consumes more electricity than Philippines or Belgium

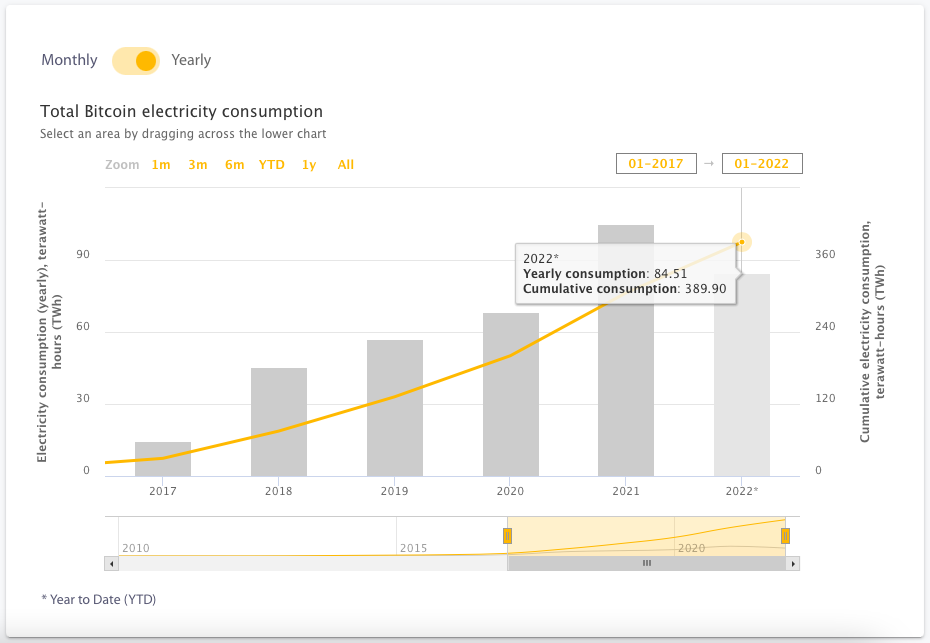

In terms of electricity consumption, bitcoin miners are estimated to have cumulatively consumed 389.90 terrawatt-hours in its history. The university researchers estimate the crypto asset consumes 96.46 TWh annually.

The estimates rank bitcoin mining as 34th among electricity consumption in the world, ahead of countries like Kazakhstan, Philippines, Finland, and Belgium.

Compared to other industries, bitcoin mining consumes more electricity than the television sets or lighting in the US but less than the refrigerators in the country. Gold and copper industries still consume more electricity than the crypto asset.

The university arm however noted that “direct comparisons to other activities that appear similar on the surface can only provide a partial – and thus necessarily incomplete – picture,” as bitcoin “is many things to many people.”

MicroStrategy (Nasdaq: MSTR) Executive Chairman and bitcoin maximalist Michael Saylor defended the digital asset, saying that “bitcoin mining is the most efficient, cleanest industrial use of electricity, and is improving its energy efficiency at the fastest rate across any major industry.”

It is worth noting that the tech firm currently holds a total 130,000 bitcoin after its latest purchase of the crypto asset.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.