Bitcoin continues to perform well, defying the predictions of many that it has moved too far, too fast and that a significant correction is needed. Two trading characteristics in the financial markets and an operating decision by several Bitcoin miners are constructive for cryptocurrency and could allow the rally to persist.

Structure of the Bitcoin Futures Curve is a Positive

Bitcoin futures prices on the CME Group’s world leading derivative marketplace trade at a premium to the underlying price of Bitcoin, a pattern which is called “contango” and is common for many commodities like pork, oil, and gold. Spot Bitcoin trades at US$58,700, while June 2021 Bitcoin futures trade about US$2,300 higher at US$60,985.

The premium between the futures and underlying commodity price generally reflects the costs of carrying the commodity. Phrased simply, an individual who buys, say, wheat today and contracts to sell it three months in the future must pay rent to store the wheat and incurs financing costs to purchase the wheat in the first place.

Unlike the physical commodities noted above, Bitcoin has no storage costs. Indeed, Bitcoin may be considered to have negative storage costs. For instance, in January 2021, Hut 8 Mining Corp. (TSX: HUT) announced it had reached an agreement with Genesis Global Capital which allows it to earn a 4% annual return on its Bitcoin holdings.

Despite its zero to negative storage costs, Bitcoin’s futures prices trade above its spot price, allowing an investor to potentially buy Bitcoin today and lock in a (modest) profit by immediately selling a future contract. This premium price solely reflects the market’s optimism about its appreciation potential.

(Some commodities trade at times in a situation of “backwardation,” where futures prices are lower than the underlying commodity price. In such a situation, the current commodity price is expected to decline, probably due to a supply-demand imbalance.)

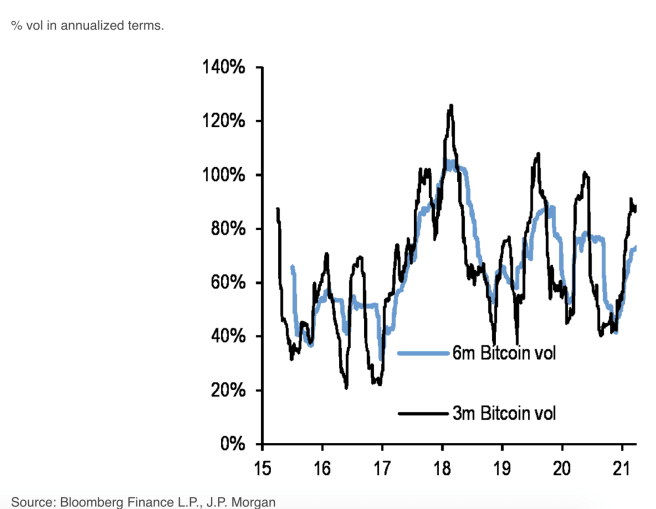

Bitcoin Volatility Declining

JP Morgan noted in a report last week Bitcoin price volatility is gradually receding. Such a decline could allow even more institutions to allocate at least a small portion of their portfolios to Bitcoin. Some well-known institutional owners include Tesla, Square, MicroStrategy, and the insurance giant Massachusetts Mutual.

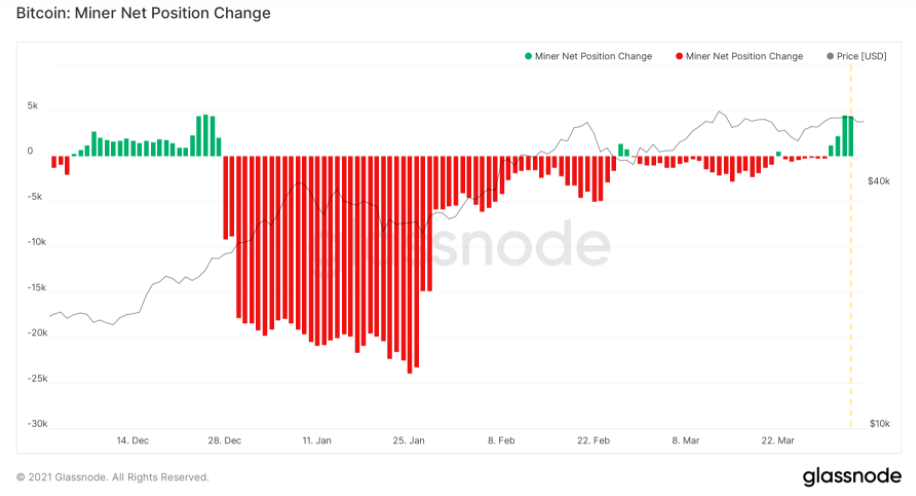

Bitcoin Miners Are Keeping More of the Bitcoin They Mine

Finally, over the last few days, Bitcoin miners have begun to hold more Bitcoin they mine for future appreciation versus selling to cover costs or lock in profits. While certainly not a foolproof indicator — just as a company’s management buying its own shares does not guarantee a stock’s outperformance — this vote of confidence has to be considered a positive. More tangibly and perhaps more importantly, in December 2020, the last time the miners adopted such a posture, the price of Bitcoin approximately doubled.

Bitcoin is currently trading at about US$58,700.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.