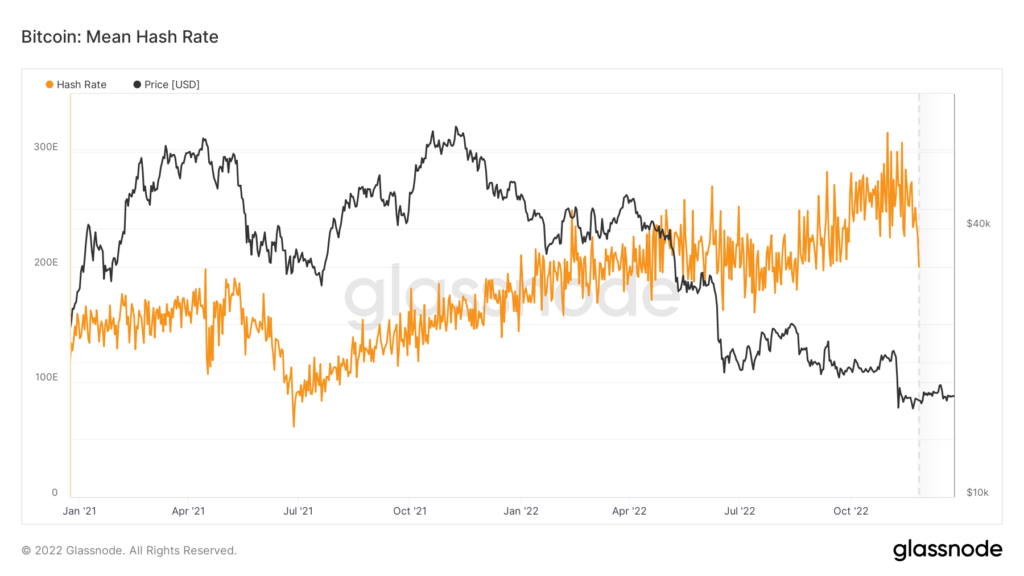

Bitcoin’s hash rate plunged about 38% leading to the holiday weekend as extreme weather pushed crypto miners in affected areas to voluntarily cut power or to completely shut down operations to ease stress on struggling power grids.

The massive winter storm, which caused a blizzard-like “bomb cyclone,” left about 1,400,000 homes and businesses from Texas to Maine without power, and saw Bitcoin’s hash rate go down from 252.98 exahashes per second (EH/s) on December 21 to 156.36 EH/s on December 24, according to data from Glassnode. This was the biggest daily drop since the start of June this year.

The hash rate is the measure of total computational power used in bitcoin mining. Basically, the higher the computing — or hashing — power, the more decentralized and resistant to attacks the network becomes.

The drop over the weekend reflects a fewer number of bitcoin miners operating to process transactions on the blockchain network during the storm. Among those that went offline to allow power grids to stabilize were Core Scientific and Riot Blockchain.

Due to extreme cold weather sweeping across the eastern and southern half of the US, we will be participating in multiple power curtailments to help stabilize the electrical grid. BTC production is expected to decrease during this time.

— Core Scientific (@Core_Scientific) December 23, 2022

Wrap up and keep warm everyone. 🥶 pic.twitter.com/WGRgXp5tDB

Due to the extreme weather conditions in #Texas, we will be closing down our Rockdale Facility to ensure the safety of our team members. Stay tuned for updates.

— Riot Blockchain Inc. (@RiotBlockchain) December 21, 2022

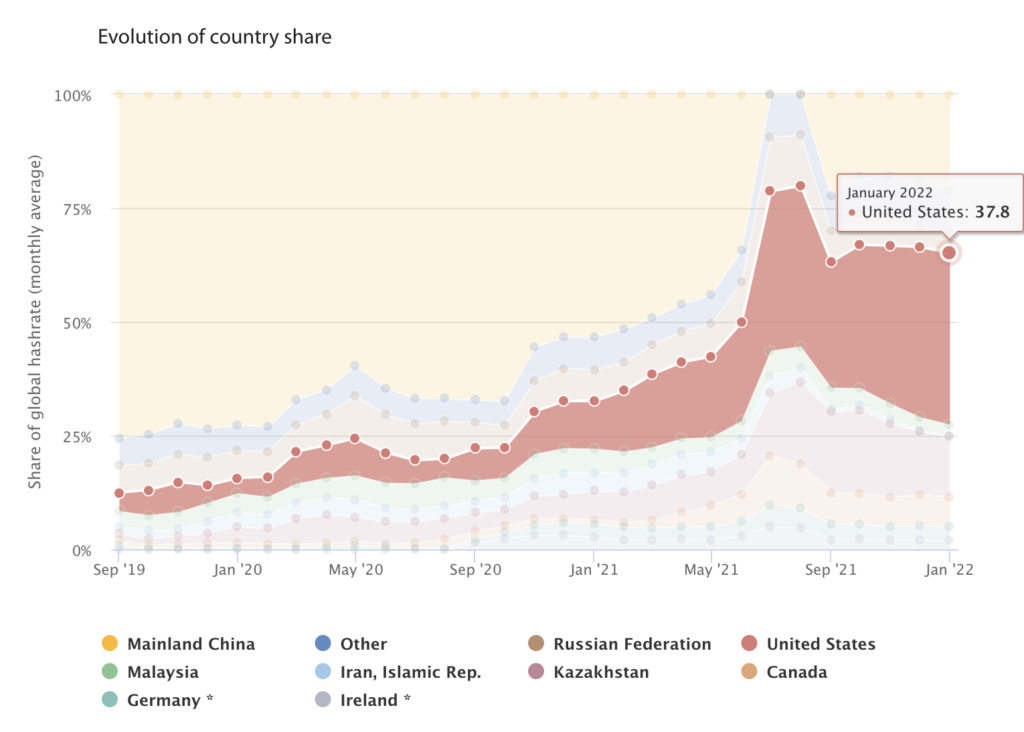

According to January 2022 data from the Cambridge Bitcoin Electricity Consumption Index (CBECI), the US is responsible for about 37.8% of the monthly average global hash rate share, the biggest piece of the pie among bitcoin mining countries in the world.

The arctic blast and resulting power outages affected New York, Kentucky, Georgia, and Texas, which are among the top mining states in the country.

By Sunday evening, with improving weather and power grids stabilizing, the hash rate has returned to normal levels, going back up to 249.02 EH/s.

Crypto analysts were also keen to point out that Bitcoin volatility is at its lowest rate since 2008. Low volatility periods are known to precede a change in trends.

$btc $btcusd

— Coiner-Yadox (@Yodaskk) December 25, 2022

Bitcoin volatility is lower than 2018 just before the 6k break

GM pic.twitter.com/J974VEHlXP

Bitcoin last traded at US$16,829.

Information for this briefing was found via Glassnode, CBECI, Twitter, and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.