Cryptocurrencies have not been performing too well since the beginning of the year, and this week continued their downward slide as major economies prepare to scale back generous monetary policies in face of rising inflation.

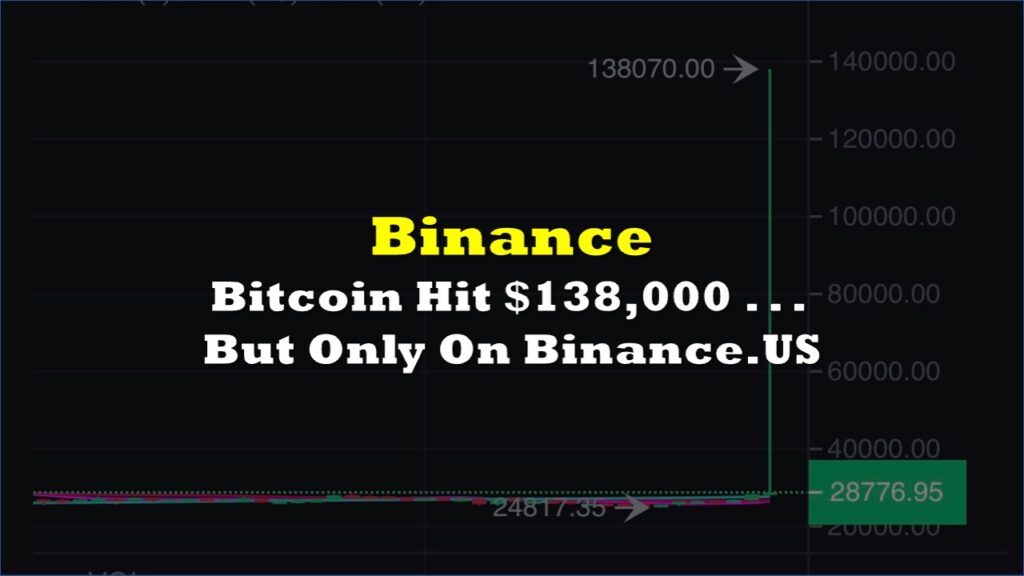

The price of bitcoin has fallen to around $36,800 at the time of writing, marking a decline of nearly 6% from Thursday. Since the start of 2022, the cryptocurrency’s price is down over 15%, which is a substantial drop from its record-high price of $98,990 back in November. Likewise, its counterpart, ethereum, isn’t faring too well either, falling by nearly 20% since the beginning of the year.

It appears that investors are becoming worrisome about major central banks pulling back their monetary stimulus policies a lot sooner than expected in an effort to rein in surging inflation. The Bank of Canada is expected to hike its key rate as early as next week, while the Federal Reserve recently signalled that it too, will begin winding down its support ahead of the timeline.

In the meantime, a number of major governments are attempting to curb the growing popularity of cryptocurrencies. This week, Russia’s central bank has proposed a complete ban on the mining and use of cryptocurrencies in the country, as digital tokens could pose a threat to the financial stability of traditional currency. Russia’s crackdown comes merely a month after China outright banned crypto mining and trading.

But, not everyone has a bearish view on crypto prices. Goldman Sachs forecasts that bitcoin will hit $100,000 within the next five years, as the cryptocurrency could increasingly erode at gold’s market share.

Information for this briefing was found via Reuters. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.