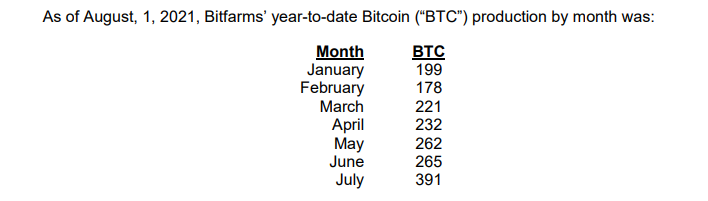

Last week, Bitfarms Ltd. (TSXV: BITF) announced the number of Bitcoin it had mined per month over the course of 2021, including 391 during the month of July alone. The market reacted positively to the news, but it seems that investors are still not fully factoring in the implications of the company’s news release.

Beginning January 1, 2021, Bitcoin decided to retain nearly all of the Bitcoin it mines, so it has held onto 1,678 of the 1,748 Bitcoin (96%) it mined in the first seven months of 2021.

Using the current Bitcoin price of around US$43,600 and then subtracting Bitfarms’ average Bitcoin production cost of US$8,400 per Bitcoin mined — comprised primarily of electricity costs — yields a current cash margin per Bitcoin mined of about US$35,000. This is akin to the company’s current EBITDA run rate per Bitcoin mined.

Bitfarms’ low production cost of Bitcoin mining is attributable primarily to the company’s access to low-cost hydroelectric power in Quebec. Bitfarms’ variable production costs could potentially move even lower in the future, reflecting the company’s attractive power purchase agreement with a utility-grade private power producer in Argentina.

At a pace of 390 Bitcoin mined per month, Bitfarms’ current EBITDA monthly run rate is about US$13.65 million (390 x US$35,000), equivalent to an annual pace of US$160+ million.

Factoring in Bitfarms’ C$75 million private placement (closed May 20), the company’s shares outstanding total around 160 million. At Bitfarms’ August 6 share price of C$7.45, its stock market capitalization is around C$1.19 billion. The company’s net cash position as of March 31, 2021 was around C$85 million. Subtracting this sum from C$1.19 billion, along with the C$75 million of cash proceeds from the private placement, implies that Bitfarms’ current enterprise value (EV) is about C$1.03 billion.

In turn, Bitfarms trades an EV-to- “normalized” EBITDA of around 5x (C$1.03 billion divided by ~C$200 million of EBITDA). An EV/EBITDA ratio of about 5x is considered very low for a growth company in any industry.

Solid Balance Sheet

Including the Bitcoin it retained, Bitfarms had aggregate cash and digital currencies of US$85 million and only US$16 million of debt as of March 31, 2021. The company reported adjusted EBITDA of nearly US$20 million in 1Q 2021. Bitfarms plans to release 2Q 2021 earnings on August 16.

| (in thousands of U.S. dollars, except for shares outstanding) | 1Q 2021 | 4Q 2020 | 3Q 2020 | 2Q 2020 | 1Q 2020 |

| Revenue | $28,432 | $11,324 | $6,795 | $7,372 | $9,212 |

| Adjusted EBITDA | $19,701 | $3,556 | $365 | $1,435 | $2,780 |

| Operating Income | $16,471 | $544 | ($2,841) | ($1,482) | ($1,510) |

| Operating Cash Flow | ($8,436) | $3,084 | $1,691 | $1,009 | $1,439 |

| Cash, Including Digital Assets | $85,431 | $5,947 | $1,324 | $1,361 | $2,332 |

| Debt – Period End | $15,913 | $28,368 | $24,385 | $21,929 | $21,384 |

| Shares Outstanding (Millions) | 145.0 | 88.9 | 84.7 | 84.7 | 84.6 |

| Number of Bitcoin Mined | 598 | 577 | 535 | 815 | 1,087 |

| Number of Bitcoin Owned | 548 | 0 | 0 | 0 | 0 |

| Average Bitcoin Price in Quarter | $45,000 | ~$15,000 | $10,615 | $8,429 | $8,261 |

| Variable Bitcoin Mining Cost Per Bitcoin Mined | $8,400 | $7,500 | $7,500 | $5,075 | $3,988 |

Bitfarms’ shares are linked closely to the market price of Bitcoin. If the value of that digital currency were to decline significantly, investor interest in Bitfarms could suffer as well.

Investors do not seem to be fully reflecting Bitfarms’ impressive Bitcoin mining results, particularly in July, in the company’s share price. Factoring in Bitcoin’s low mining costs, the company trades at a very low multiple of current operating cash flow.

Bitfarms Ltd. last traded at $7.45 on the TSX Venture Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.