On March 2, Bitfarms Ltd. (TSXV: BITF) announced that it has reached an agreement to purchase 48,000 new mining computers from MicroBT, a leading mining computer manufacturer based in China. This transaction could be transformational for Bitfarms; these computers could potentially generate around US$590 million of operating cash flow if conditions in the Bitcoin market hold at current levels. Bitfarms current stock market capitalization is about US$465 million.

The computers would increase Bitfarm’s mining hashrate, or computing capacity, by about 5.0 Exahash per second (one million trillion hashes per second, or EH/s). The devices will be delivered to Bitfarms beginning around January 2022; all deliveries are expected to be made by December 2022.

Bitcoin miners solve extremely complex math problems, the answer to which is a long string of numbers, called a hash. In turn, the speed at which a miner’s suite of computers can reach such an answer is termed the hashrate. A miner which has a total of 1 EH/s of computing capacity can create one million trillion hashes per second.

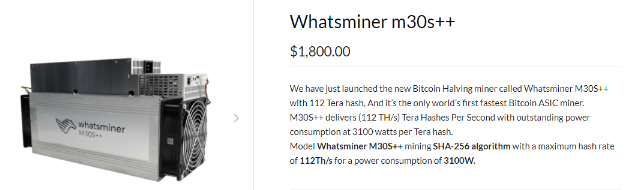

Based on the information provided by Bitfarms, each new computer to be purchased from MicroBT would have computing capacity of about 104 Terahash per second (one trillion hashes per second, or TH/s). Per MicroBT’s website, the MicroBT Whatsminer M30s++ has computing power of 112 TH/s and an electric power consumption of 3,100 watts.

The next fastest and slowest computers on that website have computing power of 410 Th/s and 88 Th/s, respectively, so we presume Bitfarms is purchasing the Whatsminer M30s++ machines. The list price of each machine on the website is US$1,800, so we calculate that Bitfarm’s outlay for the 48,000 new computers should be around US$100 million, including shipping and taxes. This however does not take into consideration potential discounts as a result of the size of the order.

Significant Potential Cash Flow Generation

In the spreadsheet below, we calculate the operating cash flow that each new Whatsminer machine could generate based on the current Bitcoin spot price of US$47,179, the current Bitcoin network hashrate of 149.3 EH/s, and Bitfarms’ average electricity costs of about US$0.04 per kilowatt-hour. The network hashrate is an estimate of how many hashes are being generated by all Bitcoin miners trying to solve the current Bitcoin block.

| ESTIMATED PROFITABILITY OF EACH WHATSMINER M30s++ COMPUTER | ||

| Bitcoin Network Hashrate | 149.3 | EH/s |

| MicroBT Whatsminer M30s++ Hashrate | 112 | TH/s |

| Percentage This Computer Represents of the Total Bitcoin Network Hashrate | 0.00007502% | |

| Number of Bitcoin Awarded Per Block, Awarded Every 10 Minutes | 6.25 | Bitcoin |

| Average Transaction Fees Per Block | 0.9426 | Bitcoin |

| Total Bitcoin Awarded Every 10 Minutes | 7.1926 | Bitcoin |

| Daily Block Reward | 1,036 | Bitcoin per day |

| Number of Bitcoin This Mining Computer is Expected to be Awarded Per Day | 0.00077697 | Bitcoin per day |

| Bitcoin Spot Price, US$ | $47,179 | |

| Expected Revenue Per Day, in US$ | $36.66 | |

| Costs: | ||

| Power Consumption | 3,100 | Watts |

| Average Electricity Price Per Kwh, in US$ | $0.04 | per Kwh |

| Daily Electricity Cost, in US$ | $2.98 | |

| Mining Profit Per Day Per Machine, in US$ | $33.68 | |

| Mining Profit Per Year Per Machine, in US$ | $12,294 | |

| Sensitivities: | ||

| Each US$10,000 Change in Bitcoin Price Affects Annual Profit by About, in US$ | $2,800 | |

| Each 10% Increase in Bitcoin Network Hashrate Decreases Annual Profit by About, in US$ | $1,200 |

Each new Whatsminer device should generate annual operating cash flow of around US$12,300, meaning that 48,000 machines, when fully operational, should produce about US$590 million of yearly cash flow (at current market rates).

Put another way, the internal rate of return on Bitfarm’s US$100 million investment could be several hundred percent, and the payback period on that investment may only be around two months, once fully operational and based specifically on the scenario outlined above.

Each US$10,000 change in the price of Bitcoin would impact the annual cash flow of each machine by about US$2,800, or a total US$134 million for all 48,000 machines. As a consequence, the digital currency price would have to drop to about US$11,500 for the cumulative annual cash flow of the 48,000 machines to equal their estimated US$100 million purchase price.

Bitfarms is trading at $5.69 on the TSX Venture Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

2 Responses

Just bought 3000 shares

Way undervalued