After exceeding redemption limitations this quarter, Blackstone Inc.’s (NYSE: BX) $69 billion real estate fund for wealthy individuals announced it will limit redemption requests, sending the private equity firm’s stock down the most in more than five months.

According to Blackstone Real Estate Income Trust (BREIT), withdrawal requests exceeded the monthly limit of 2% of net asset value and the quarterly maximum of 5%. The withdrawal structure of the fund is intended to prevent a liquidity mismatch.

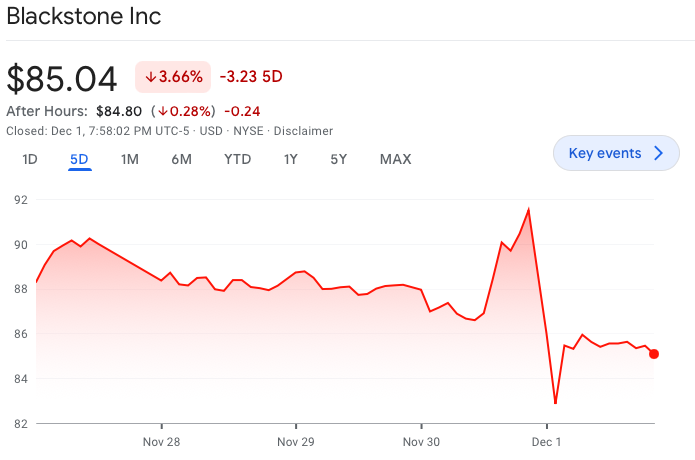

Shares of the firm fell as much as 9.5% following the news.

“If BREIT receives elevated repurchase requests in the first quarter of 2023, BREIT intends to fulfill repurchases at the 2% of NAV monthly limit, subject to the 5% of NAV quarterly limit,” BREIT said in a letter Thursday.

The real estate fund has grown its portfolio pretty successfully, but it is now facing its most difficult test. Rising interest rates threaten to depress home prices and make low-cost debt more difficult to obtain. Despite outperformance by stocks — total net gains for its most popular share class were 9.3% in the nine months ended September — inflows are decreasing and redemptions are increasing.

YTD performance through October of every institutional publicly traded real estate mutual fund along with BREIT pic.twitter.com/htEJ2X0GWx

— Jake (@EconomPic) December 1, 2022

In a statement earlier, Blackstone Real Estate Americas CEO Nadeem Meghji said BREIT was designed to withstand tough markets, with its portfolio primarily weighted toward rental housing and warehouse assets in the US Sun Belt.

“This is exactly what you want to own in an environment like we are in today,” he said.

This year, the REIT has invested $21 billion in interest-rate swaps to protect itself against rising debt costs. Such swaps have increased in value by $4.4 billion, contributing to the portfolio’s overall worth.

The real estate fund “is operated with substantial liquidity and is structured to never be a forced seller of assets,” Meghji added. “All of this enables BREIT to deliver outstanding performance for its investors.”

“Our business is built on performance, not fund flows, and performance is rock solid.”

— Clifford Asness (@CliffordAsness) December 1, 2022

When we were long great businesses at cheap prices and short overvalued crap in 2020 we were rock solid too in our OWN OPINION.

Do these guys believe their own bull? https://t.co/ikQKVi4Swm

However, in recent months, some financial advisers have been more cautious about client exposure to illiquid assets, with certain advisers at UBS Group AG limiting exposure to BREIT. A significant portion of redemptions have come from Asia this year, according to a person familiar with the subject who asked not to be identified due to private information.

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.