It’s been a few hours now since Canada’s Federal government announced a plan for $82 billion worth of emergency aid to prop up the Canadian economy and, so far, nobody really knows what to make of it.

The Globe and Mail‘s ever-topical Andrew Willis drew an apt parallel to ESPN’s grading of the Buccaneers move yesterday to acquire Tom Brady in free agency; how could anyone possibly tell how something like this will work out? Willis says that the execution will make a difference; that they can screw it up pretty easy by fumbling the hand off, and that seems obvious enough. “The move isn’t going to work out very well for the Buccs if Tom Brady doesn’t play well next year, Jim…”

The premise here is that Canadians’ monthly expenses don’t go away just because the COVID-19 quarantine stopped the business that they run or work for, and The Dive can relate.

The system is congealed…

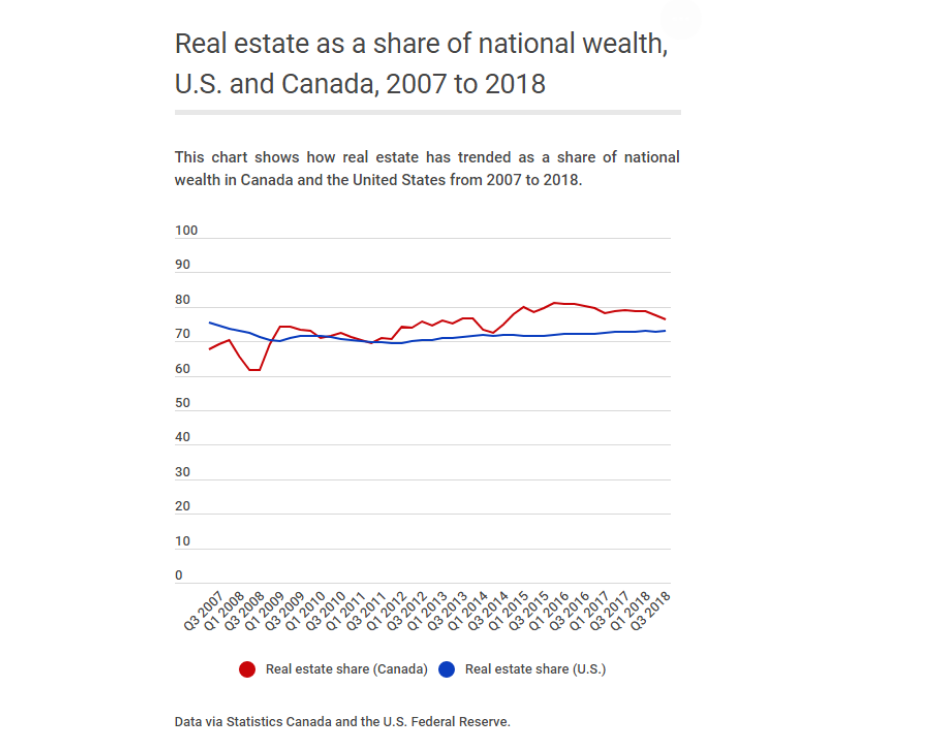

The largest recurring expense in any household or business is invariably the rent on the house or shop. On April 1, rent is due, and millions of Canadians who just lost all income certainty are going to tighten up all spending to keep from ending up out in the rain, or join the all too many people who just plain can’t afford the monthly ticket on accommodations, and set up in a tent city.

Very little of Canada’s active residential or commercial property is owned free of encumbrances, so the landlords stiffed by those tenants (and the homeowners who can’t make their mortgage payments for the same reason) end up stiffing the banks who haven’t got the desire, capacity or means for serial foreclosures, or to dump all of the defaulted debt on the Canada Mortgage and Housing Corporation, who isn’t interested in taking it all on, either. Better for everyone if everyone just pays their damned rent and keeps this whole thing spinning.

Willis is right about the execution mattering, because the efficiency with which and the means by which this money gets into the economy makes all the difference concerning what it does and how investors might navigate its potential impact. NFL fans know that the sticker price on a player contract is just there for the headlines. The guaranteed money tells the story.

Probably needs some liquidity…

The $82 billion in emergency aid today includes $27 billion in direct stimulus and $55 billion in tax deferrals. This latter sum was billed by the ministry of finance as “money that will stay in the economy,” which is certainly one way of putting it.

From the perspective of the public purse, the difference between direct stimulus (writing checks), and tax deferral stimulus (which, in a weak economy, is half the distance to tax relief stimulus) is income statement semantics. Paying more and collecting less amount to the same thing, but to the broader economy being stimulated, the difference sets the trajectory that determines where it lands, and where it lands has everything to do with its impact.

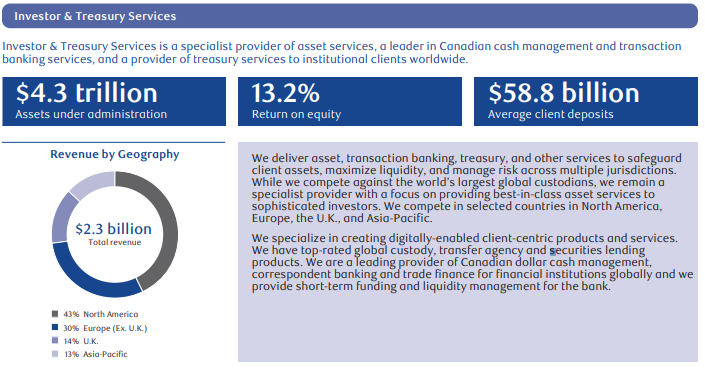

Generally, tax relief most benefits those who pay the most taxes. The Royal Bank of Canada (TSX: RY) paid $3 billion in taxes last year on a $15.9 billion bottom line that the charter bank earned, in part, on revenue generated from investment management and custodial fees ($5.7 billion), service charges ($1.3 billion), card services (somehow different from service fees? $1 billion), securities lending ($8 billion), on top of $24.8 billion from the regular kind of lending. The four other chartered banks presumably did similar numbers all through no small amount of taxpayer assistance in the form of loan guarantees, deposit insurance and a charter that gives them the effective right to print money. Whether or not stimulating charter banks “keeps money in the economy,” is open to interpretation, we suppose. They’ll undoubtedly know what they want to do with it.

Maybe the economy needs a lube job?

Canada being a resource-based economy, it stands to reason that some of that stimulus ought to be directed at the country’s beat-up oil sector, who will surely be agitating for it but, as an effective means of stimulus, the government might as well just dump the money in a tailings pond. Canadian oil companies have tax avoidance down to a fine art. Canadian Natural Resources (TSX: CNQ), for example, paid tax at an actual rate around 8% in 2019, and are presently sitting on deferred income taxes of $10.5 billion that they’ve been saving for just such an occasion.

With Western Canadian Select trading at $11.55 a barrel, any Canadian oil executive who invested money saved in tax deferrals in operations ought to be fired for malpractice. CNQ has $19 billion in long-term debt to pay off, and only $101 million in cash, because there’s no sense having all that cash laying around when it could be spent on a buyback. CNQ spent $203 million buying its stock out of the market this year, $238 million last year.

There’s no way to get a reasonable handle on how to approach this until we have more details about the rules of engagement, and even then it will be complicated. If the goal is to have an effect on the broader economy, it’s hard to conceive of a tax relief stimulus that is efficient, quick and figures to be effective. There is, of course, another way.

They should try taking a bit of weight off.

The federal government also announced Wednesday that they would be implementing a payment holiday on student loans for the duration of the COVID-19 crisis. The payment holiday applies only to federal student loans and surely gives a measure of relief to Canadian professionals and students who can now use that money to hoard more toilet paper. Conceivably, the government could do that with mortgage debt, too.

A federal rent freeze, mortgage payment holiday, and interest freeze would give the landlords and tenants a whole lot more room to move, and provide a massive stimulus to the economy without costing the federal treasury a dime. The lenders wouldn’t even lose anything. The country could just pick up the debt servitude right where it left off as soon as it’s out of the woods, while keeping the considerable amount of economic activity that doesn’t require group attendance going apace. With the rent shackles off, all sorts of real-economy businesses might start to look like attractive investments. It’s all uncharted territory, and an economy freed up by a rent freeze seems a lot more fun to blog about than one trying to figure out what to do with $55 billion of tax deferrals with a spotty distribution.

The author has no securities or affiliations related to any organization mentioned. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.