Crypto lender BlockFi’s newest court filing in its chapter 11 proceedings has shed a new light on the company’s financial dealings prior to its bankruptcy application.

The company filed its Schedules of Assets and Liabilities and its Statement of Financial Affairs on Wednesday.

The filings contain information on BlockFi’s assets and liabilities, and disclose certain payments made by BlockFi to insiders and other parties prior to the bankruptcy filing.

— BlockFi (@BlockFi) January 9, 2023

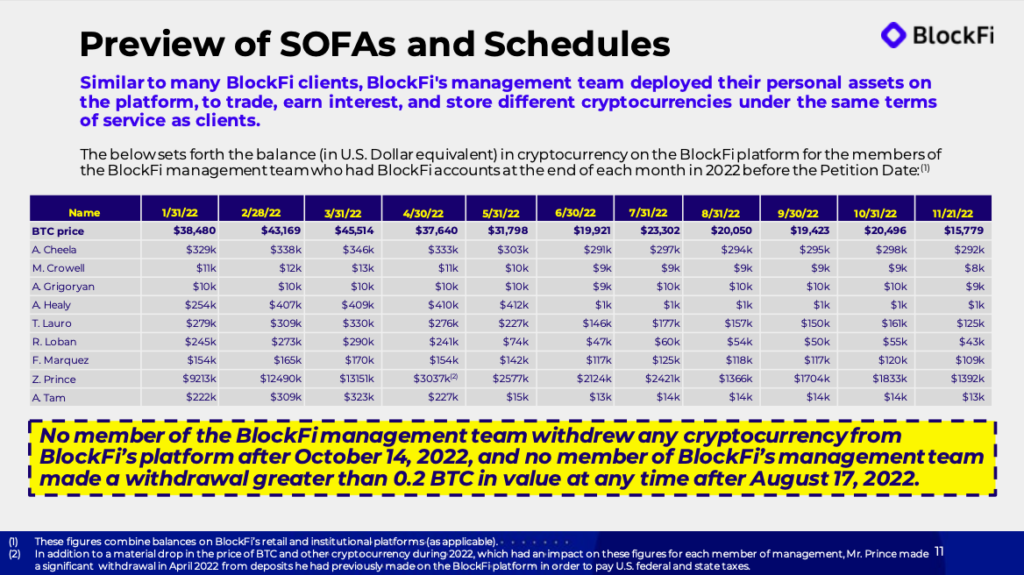

In the presentation, the firm showed the crypto balances the BlockFi management team held at each month-end of 2022. Aside from changes due to declining bitcoin prices, one significant item is CEO Zac Prince seemingly withdrawing around $9.3 million worth of crypto in April 2022 and approximately $850,000 in August 2022–right around the time now-bankrupt crypto exchange FTX extended a $400 million facility to BlockFi.

“To protect clients’ funds, BlockFi executed a transaction in which FTX committed to loan $400 million in cryptocurrency on a junior basis to BlockFi’s obligations to its clients, enabling BlockFi to process billions of dollars in clients’ requested withdrawals and other transactions between June and November 2022,” the firm said in its statement.

READ: BlockFi Revealed To Have $355 Million Locked In FTX, $671 Million Defaulted Loan To Alameda

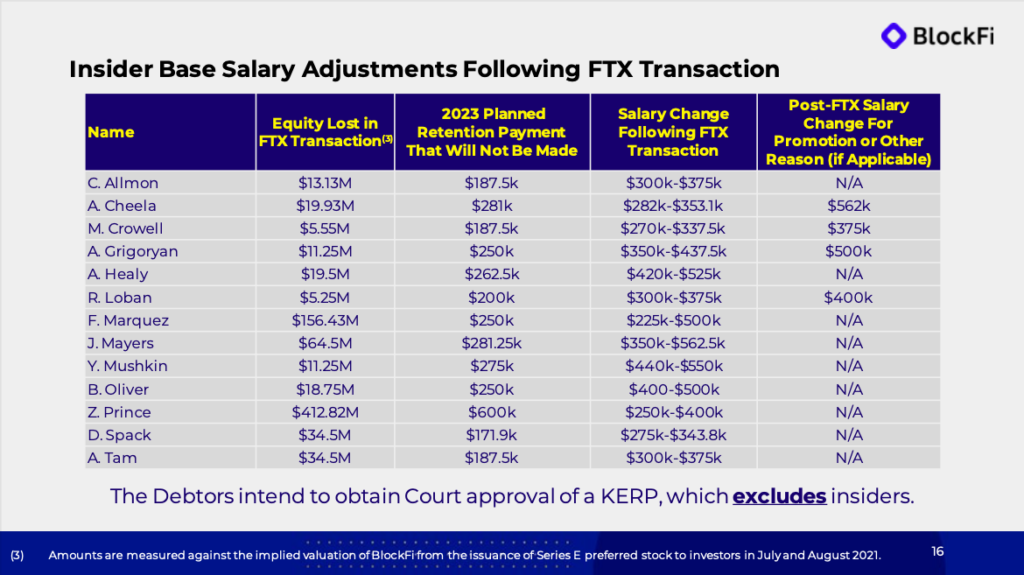

While the FTX “bailout” stabilized BlockFi and protected clients, as the firm said, “it led to BlockFi’s executives and employees losing their own equity value.” That’s the time when the company’s board took a multi-pronged approach on compensation.

First, BlockFi made one-time payments to essentially restore the monies and make some employees whole after their equity was made “worthless” by the FTX loan. Prince had the biggest equity lost at $413 million followed by COO and co-founder Flori Marquez.

The board also devised a retention program offering key employees the opportunity to earn cash payments of up to 50% of their base salary if they stayed until February 2023. But after the bakruptcy filing, this was discontinued.

The strategy also included “historically timed compensation raises with material capital markets activity and fundraising.” Because of the huge impact of the FTX transaction on management equity, BlockFi’s board of directors increased base salary and made retention payments, among other things, to guarantee business-critical expertise and competencies were preserved.

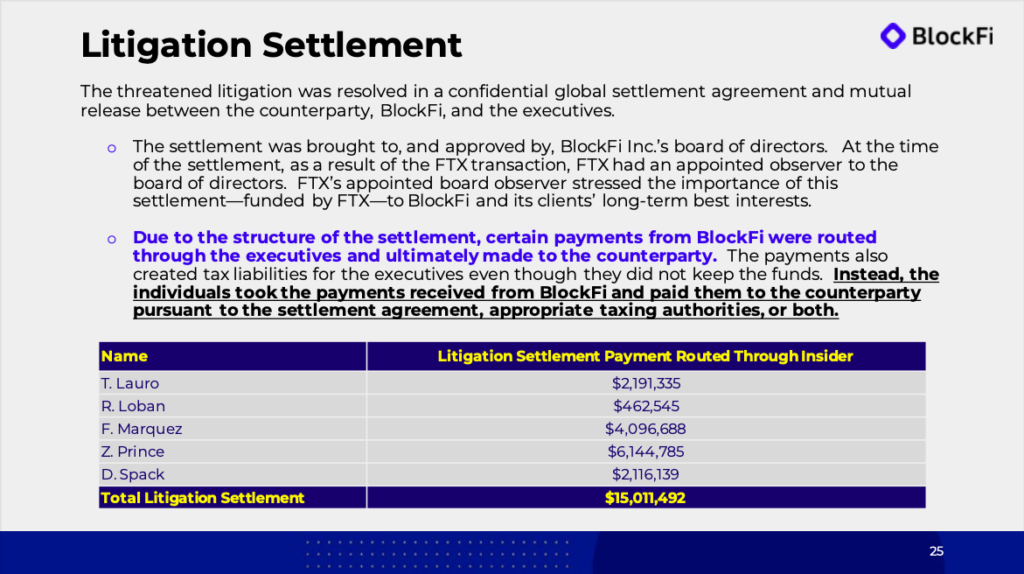

The company also revealed in the filing that it reimbursed an investor roughly $15 million in August 2022 to resolve a threatened litigation over the company’s plummeting stock value in summer 2022. However, due to the “structure of the settlement, certain payments from BlockFi were routed through the executives and ultimately made to the counterparty,” with Prince routing for $6 million and Marquez for $4 million.

“The payments also created tax liabilities for the executives even though they did not keep the funds. Instead, the individuals took the payments received from BlockFi and paid them to the counterparty pursuant to the settlement agreement, appropriate taxing authorities, or both,” the firm explained.

At that time–due to the FTX transaction–FTX had an observer on BlockFi’s board who “stressed” the importance of the lawsuit settlement to the firm and its clients’ long-term best interests. The settlement was “funded by FTX” and was presumably routed to the executives.

According to BlockFi attorney Joshua Sussberg, the settlement resolved claims by the petitioner investor who purchased equity shares issued as part of executive compensation packages. The shares were sold at a discount to the company’s January 2022 valuation of $6 billion to $8 billion, but their value fell during the summer as Voyager Digital and Celsius Network filed for bankruptcy, causing widespread mayhem in crypto markets.

The BlockFi investor threatened to sue, claiming that BlockFi and its officials should have been more forthcoming about the bitcoin market’s contagion dangers.

Amidst all this, BlockFi announced in June 2022 that it is “reducing headcount by over 20% to attempt to further protect client value and set a course to return to profitability,” a report that still continued to hover over the firm until it filed bankruptcy.

READ: Another One Bites The FTX Dust: BlockFi To File For Bankruptcy, Cut Jobs

Due to the FTX transaction, the bankrupt crypto exchange got close to acquiring BlockFi at a 99% discount; FTX was reportedly to pay just $25 million for BlockFi, which last summer held a valuation of $4.8 billion.

Information for this briefing was found via Reuters and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.