On February 8th, Cenovus Energy (TSX: CVE) reported its fourth-quarter and full-year 2021 results. The company reported annual revenues of $46.36 billion, up 250% year over year. Gross profit also grew over 200% to $18.55 billion, while net income came in at $553 million, or a $1.09 earnings per share, up 123% year over year. The company generated $4.68 billion in free funds flow compared to a negative $724 million outflow last year. The companies net debt grew year over year from $7.18 billion to $9.59 billion at the end of 2021.

For the quarter, the company saw revenues grow 306% year over year to $13.93 billion, gross profits grew 215% to $5.44 billion. The company had an average upstream production of 825,300 BEO per day and 469,900 barrels per day in downstream throughput. This is up 77% and 178% year over year, respectively.

Cenovus Energy currently has 22 analysts covering the stock with an average 12-month price target of C$22, or a 13% upside to the current stock price. Out of the 22 analysts, 4 have strong buy ratings, 17 have buys and 1 analyst has a hold rating on the stock. The street high sits at C$28 representing a 44% upside, while the lowest 12-month price target comes in at C$12.

In BMO Capital Markets’ note, they reiterate their C$25 12-month price target and Outperform rating, saying that even though the quarter came in worse than expected, the company was able to generate $1.1 billion in free cash flow in the fourth quarter brought its net debt below $10 billion. BMO expects that the company will reach its $8 billion net debt target by the end of the first quarter as the company realizes proceeds from a few assets that won’t obstruct its free cash flow levels.

For the quarter, the company reported fourth-quarter free cash flow of $0.97 per share, below their $1.05 estimate. The miss came from a $167 million one-time G&A expense related to an incentive program. Earnings per share came in at ($0.27), significantly lower than their $0.40 estimate. This comes after the company realized a $1.9 billion impairment in their U.S manufacturing unit.

The company’s upstream segment reported operating margins of $2.55 billion, below BMO’s $2.65 billion estimate, while production came ahead of their 813,390 BOE per day estimate. Downstream operating margins of $42.0 million came in line with BMO’s estimate but were almost a third of what the consensus estimate was. Throughput of 469,000 barrels a day beat BMO’s estimate but was below the consensus estimate, which they believe was due to weakness at its U.S manufacturing segment.

Lastly, BMO says that even though Cenovus put up a worse than expected quarter, they still believe the company’s shares are undervalued as “it has one of the best portfolios of long-life, low-decline oil sands assets.” They also believe in the companies ability to return cash to shareholders to be unparalleled versus its peers.

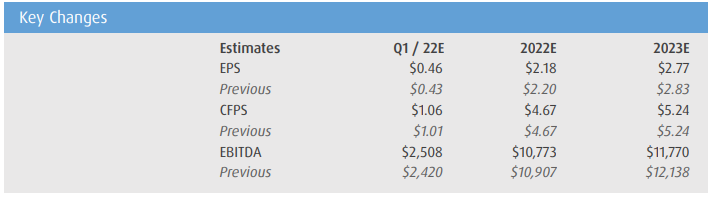

Below you can see BMO’s updated first quarter 2022 and full year 2022 and 2023 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.