This morning BMO lowered its 12-month price target on Cenovus Energy (TSX: CVE) to C$6.00 from C$7.50 and reiterated its outperform rating on the stock. This comes after Cenovus reported their third-quarter results. Randy Ollenberger, BMO’s analyst, says that Cenovus’ results were slightly below their expectations. He said, “The company’s upstream assets performed well this quarter while the downstream underperformed due to weaker margins and lower utilization.”

Ollenberger acknowledges the mixed reaction to the Cenovus/Husky merger and comments, “we think this could act as a drag on share price performance until the company can demonstrate cost synergies and accelerate debt reduction through asset dispositions.”

Cenovus’ upstream operations beat expectations. Operating margins were $668 million compared to BMO’s estimate of $632 million and the street’s consensus of $625 million. “The beat was primarily due to strong realized pricing at its oil sands assets,” says Ollenberger. However its downstream operations missed, generating an operating margin loss of $74 million. That’s compared to the estimate of a loss of $53 million, and the streets estimated loss of $45 million. Cenovus generated cash flow of $0.34 per share, which is slightly below the consensus of $0.36 per share.

Ollenberger says that, “Cenovus will need to demonstrate the strategic rationale and deliver on its cost reduction targets. We think dispositions (particularly the Asian assets) could accelerate debt reduction and provide a positive surprise.” Both Husky and Cenovus delivered less than stellar third-quarter results, with Husky writing down a significant portion of their prized midstream assets.

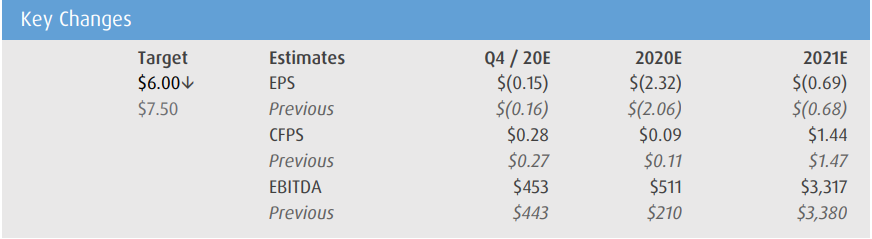

With BMO downgrading the stock, Ollenberger has slightly lowered his fourth-quarter and 2020/2021 expectations. You can see the changes below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.