Micron Technology (NASDAQ: MU) is expected to report its fiscal fourth quarter results on September 29 after the market closes. Analysts expect revenues to come in at $6.69 billion, almost down a quarter from the $9.5 billion estimate they were expecting over the summer. The consensus estimate for net income also dropped significantly to $1.4 billion, down from $3.2 billion over the same time period.

Analysts’ price targets have also declined over the last six months, with the average 12-month price target dropping from $104 in June to $70 today. Micron currently has 37 analysts covering the stock, with six having strong buy ratings, 20 have buy ratings, nine analysts having hold ratings, and the last two analysts have sell ratings on the stock.

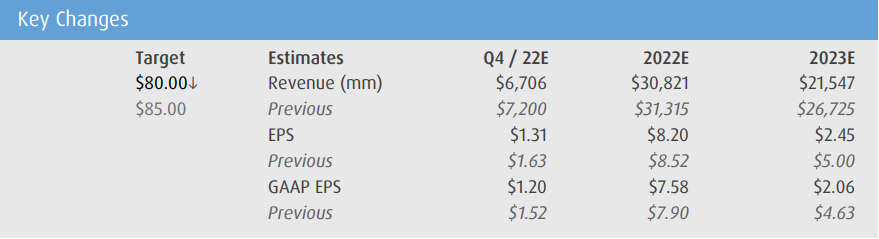

In BMO Capital Markets’ earnings preview note, they reiterate their outperform rating but cut their 12-month price target to $80 from $85, saying that their thesis will “be given a severe test over the next two quarters or so.”

They add that the reason they are keeping their outperform rating on the stock even with their thesis being tested is that they believe the industry will be able to demonstrate CapEx discipline while expecting there to be a better supply and demand balance in 2023. BMO also commented that it they believe that the risk versus reward is heavily skewed to the upside, given their downside support is at $45 as this is the company’s trailing book value per share.

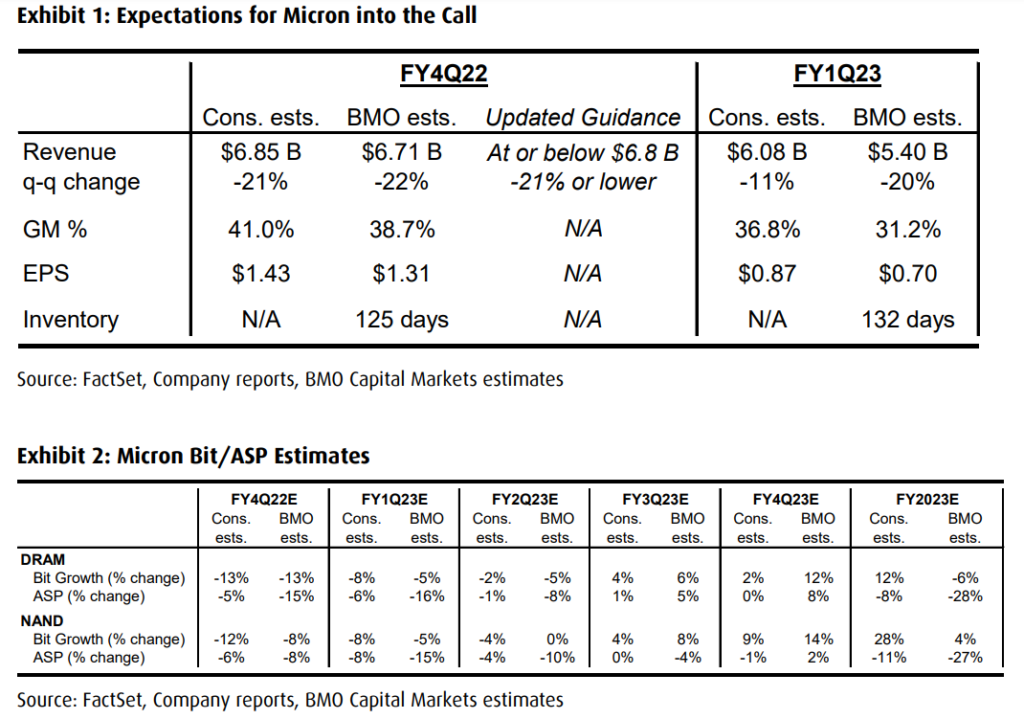

With Micron already pre-announcing their results, BMO says that based on their research, the outlook for DRAM and NAND flash over the “near to medium term” is very bleak and are forecasting that Micron will see a double-digit price decline for both DRAM and NAND for the next two quarters with the possibility that it continues.

BMO believes this to be the case for a variety of reasons, which include “very poor demand in the majority of the end markets, from handsets to PCs, to incremental weakness/excess inventory in other markets such as data center as well.”

With this, they expect revenues to come in at $6.71 billion, down 22% sequentially, and earnings per share of $1.31. Specifically, they expect DRAM revenues to come in at $4.64 billion, down 26%, and the average selling price to be down 15%. Lastly, they expect this segment to have 42.1% gross margins, down from 50.8% last quarter.

While for the Trade NAND segment, they forecast revenues to be $1.93 billion, down 16%, with average selling prices down 8% sequentially. They expect gross margins of 32%, versus the 37.5% margins Micron saw last quarter.

With these forecasts, BMO has elected to lower their fiscal 2022 and 2023 estimates which you can see below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.