Last week, Netflix (NASDAQ: NFLX) reported their fiscal third quarter financial results. The company reported revenues of $7.48 billion, a 22.7% increase year over year. The company reported an operating margin of 23.5%, or a $1.755 billion operating income. They added 4.4 million paid subscribers this quarter, bringing the total to 214 million paid users. In the news release, they say that the subscriber growth was hindered by a “lighter-than-normal content slate in Q1 and Q2,” due to COVID-19 production delays.

Netflix currently has 45 analysts covering the stock with an average 12-month price target of $655.37, this average is up after the earnings as multiple analysts raised their price targets or recommendations. Out of the 45 analysts, 13 have strong buy ratings, 20 have buys, 8 have hold ratings, 3 have sell and 1 analyst has a strong sell rating. The street high sits at $800 from Wells Fargo while the lowest sits at $340.

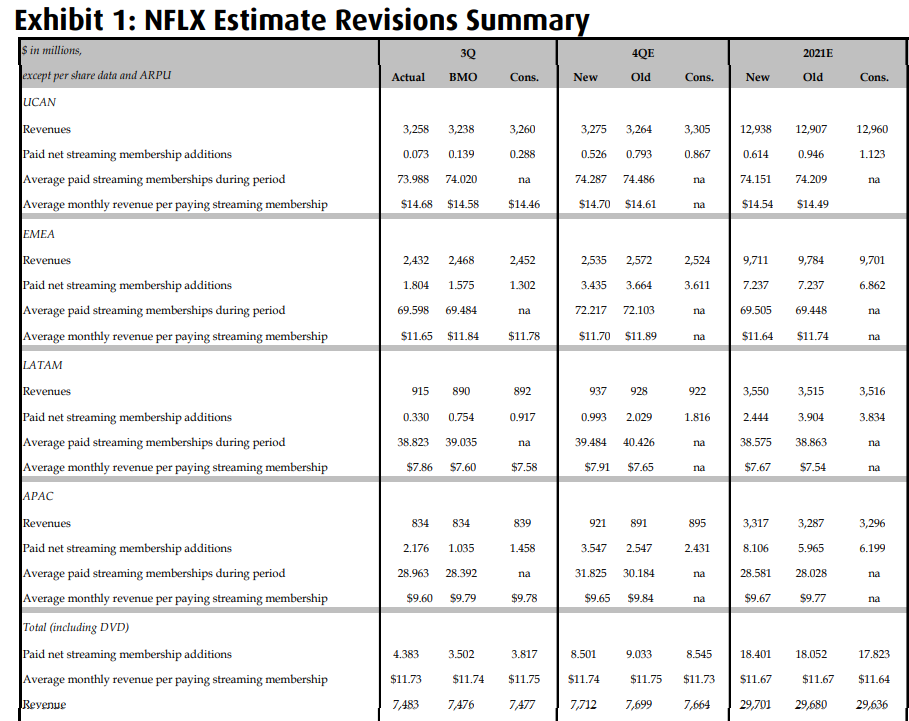

In BMO Capital Markets review, they reiterated their $700 price target and Outperform rating saying that Netflix’s Squid Game is leading a hopefully strong content slate into the second half of 2022. They call the results broadly in line with expectations and believe that the Asia-Pacific region grew the most for subscribers. They expect that Netflix will look towards that market to first promote its mobile gaming efforts.

For the quarter, subscriber net adds came in at 4.4 million, beating BMO’s 3.5 million estimates, while revenue came in at $7.48 billion in line with their $7.47 billion estimates. BMO writes, “Management still expects 2021 FCF to break even and anticipates being FCF positive on an annual basis in 2022 and beyond.”

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.