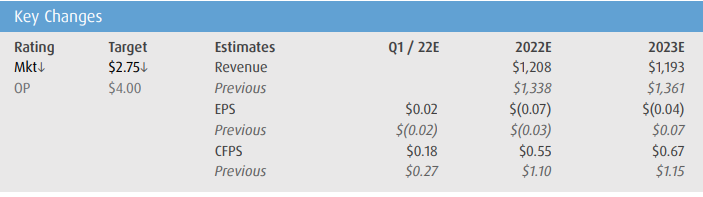

On April 18, BMO Capital Markets lowered their 12-month price target and downgraded IAMGOLD Corporation (TSX: IMG). BMO now has a $2.75 12-month price target, down from $4.00, and has a market perform rating, which was lowered from outperform. BMO says that this downgrade comes after doing a review of their estimates as well as a review “on valuation as IAMGOLD share prices have appreciated YTD,” given the equity is up 19% year to date.

IAMGOLD currently has 10 analysts covering the stock with an average 12-month price target of C$4.10. Out of the 10 analysts, 2 have buy ratings, 7 have hold ratings and 1 analyst has a sell rating on the stock. The highest 12-month price target comes in at C$6.50, which represents a 39% upside to the current stock price.

First, BMO believes that the Côté review is negative. IAMGOLD currently is reviewing the project scope and budget, which is expected to be released in the second quarter of this year. They believe that the results will be negative versus IAMGOLD’s guidance. BMO says that they are estimating the project to spend US$1.96 billion, slightly above the company’s US$1.866 billion estimates. They add, “we see risk that the budget could grow further.”

Additionally, BMO has slashed their estimates for full-year 2022 and 2023, though they expect IAMGOLD to see a strong first-quarter result due to strong results at Essakane and Rosebel/Saramacca. They admit that their previous estimates were significantly above 2022 guidance and have revised down accordingly.

Lastly, BMO believes that the agreement between Resource Capital Funds, which prompted a whole new selection of Board of Directors and an expected announcement of a new “strong permanent CEO,” will be a positive catalyst for the stock in the coming months. They do believe a weak readthrough of Côté would outweigh those positives.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.