Starbucks (NASDAQ: SBUX) reported their fiscal third quarter results on July 27. The company beat the street estimate of $7.27 billion in revenue, with them reporting $7.49 billion in top-line revenue. Revenue grew 77.6% year over year, while gross profits grew more than 100% to $2.32 billion. Gross margins came in at 31% while operating margin came in at 19.9%. Net income came in at $1.15 billion while earnings per share were $0.97 for the quarter.

Off the beat, analysts raised their 12-month consensus price target to $131.11, from $126.37 which was the consensus target before the earnings were released. Kalinowski Equity has the street high price target of $148, while BZ Bank’s $95 price target is the lowest. Starbucks has 36 analysts cover it, with 11 having strong buy ratings, 11 having buys, 13 having hold ratings and one analyst has a strong sell on the stock.

BMO Capital Markets raised their 12-month price target on Starbucks to $140, up from $125, and reiterated their outpeform rating on the stock. They add, “we gain confidence in SBUX’s US sales and overall margin potential, which should continue creating upside opportunities for estimates over next 12+ months.”

The biggest takeaway BMO has from Starbucks earnings is that their US momentum will continue into the year end. This quarter their US growth accelerated 4% and fourth quarter guidance implies another 2%. They say, “We are encouraged to see SBUX hold onto its check gains and realize record food attachment rates despite the normalizing operating environment.”

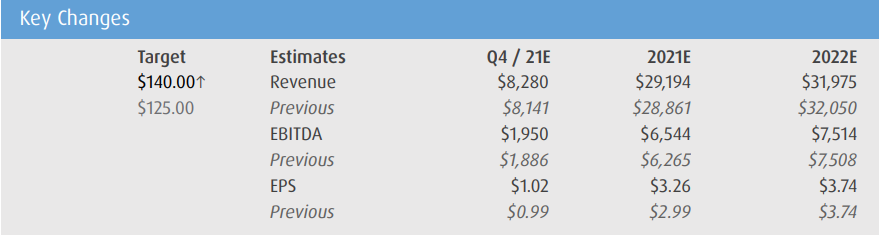

Below you can see BMO’s updated fourth quarter, 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.