Last week Aritzia (TSX: ATZ) reported their fiscal fourth quarter ending February 26 results. The company reported revenues of $444.32 million, an increase of 66% year over year. Retail revenues amounted to $262.35 million, for an increase of 123% year over year. eCommerce revenue also remained strong, growing 22% year over year to $181.97 million for the quarter.

Gross profits also grew substantially to $179.5 million, up 75% year over year. However, expenses also grew 66% year over year as the company could not outrun inflation, with expenses totaling out at $120.2 million. This put net income flat on a year-over-year basis at $34.23 million, or $0.29 earnings per share.

Additionally, Aritzia said that it grew its active US clients by over 100% over the fiscal year, and “strategically managed global supply chain disruptions to ensure product availability to meet demand.” They also note that they repurchased 164,200 shares under their normal course issuer bid at an average price of $54.79 for a total consideration of $9 million.

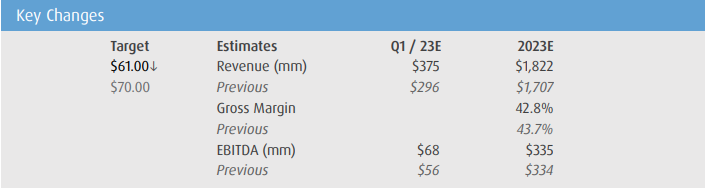

Lastly, Aritzia said it was on track to hit its $375 million fiscal first-quarter revenue guidance, and expects net revenue for the year to be $1.8 billion. They also expect gross profits to take a 1% drop while expenses will slightly grow as a percentage of revenue for the full year.

Aritzia currently has 8 analysts covering the stock with an average 12-month price target of C$62.14, or a 67% upside to the current stock price. Out of the 8 analysts, 3 have strong buy ratings, 4 have buy ratings and the last analyst has a hold rating on the stock. The street high sits at C$70, which represents a 90% upside to the current stock price.

In BMO Capital Markets’ note on the results, they reiterate their outperform rating and lower their 12-month price target from $70 to $61, saying that the fourth quarter results came in strong but guidance proves inflation is hitting the operations hard but the long-term margins should go higher.

On the results, BMO says that the company beat their adjusted EPS estimate of $0.24 with the actual results coming in at $0.34. While adjusted EBITDA was also better than their $49 million estimate. On the top-line growth, BMO says that they are glad to see the growth momentum has continued into the fiscal fourth quarter. Combined with a strong top-line guide, they believe that over the long term, e-commerce and the U.S market provide Aritzia with a margin tailwind.

Lastly, BMO says that Aritzia’s success in the U.S will be the growth engine for the company. They note that customers “are responding extremely well to Aritzia’s boutique experience, e-commerce offering, and product assortment.” This has provided Aritzia with a solid growth runway and they believe that this will be Aritzia’s segment to give the business exceptional growth.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.