Last week, Peloton Interactive Inc (NASDAQ: PTON) announced that their new Peloton Tread will be available in the United States, Canada, and the United Kingdom on August 30, while it will be available in Germany in fall 2021. The company revised multiple safety features after they recalled the product due to consumer safety incidents.

Peloton has 29 analysts covering the stock with an average 12-month price target of $134.23, or an 18% upside. The street high sits at $185 from Keybanc Capital Markets, while the lowest comes in at $45. Out of the 29 analysts, 7 have strong buy ratings, 15 have buy ratings, 5 have holds and 2 have sell ratings.

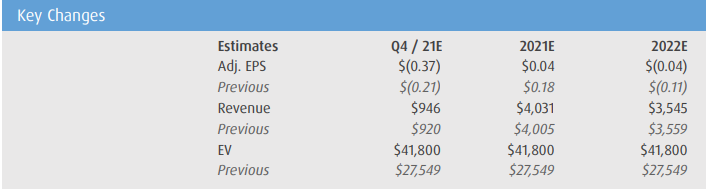

BMO Capital Markets, which is the Peloton bear, has the street low price target of $45 and an underperform rating. The firm recently lowered their 2021 and 2022 estimates. They say that they have been talking to investors, and in their view, the consensus view is that Peloton beats fourth-quarter estimates but then falls short in the first quarter of 2022. They write, “we worry that decelerating sales growth coupled with increasing CAC amid growing competition and lapping 2020 WFH, will continue to highlight the meaningful divide between fundamentals and share price.”

BMO believes that since COVID, there has been a lot of subscriber pull-forward and with Peloton’s revenue mix being weighted 80% equipment, it means that Peloton might not hit the same year-over-year revenue increase as the street is predicting. BMO’s base case is that equipment sales will be relatively flattish as the company will need to add 1.2-1.3 million new CF subscribers to just get to fiscal 2021 equipment revenue.

Due to this revenue mix, BMO believes that the company should be trading at a lower NTM sales multiple. They believe that their equipment segment should trade closer to other consumer equipment manufacturers, which trade at around 1x NTM sales.

Below you can see BMO’s updated fourth quarter, full year 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.