Maple Leaf Foods (TSX: MFI) is expected to report its second-quarter financial results on August 2. The consensus estimate for the company’s revenue is $1.266 billion, up from $1.159 billion a year ago. For net income, analysts are expecting the company to report $49 million, higher than the $9 million the company reported in the same period for 2021.

Maple Leaf Foods currently has 6 analysts covering the stock with an average 12-month price target of C$40.33, or an upside of 56%. Out of the 6 analysts, 2 have strong buy ratings and the other 4 have buy ratings. The street high price target comes in at C$45 which represents an upside of 74%.

In BMO Capital Markets’ note, they have lowered their estimates for Maple Leaf’s second-quarter results based on several headwinds they believe will hit the company. Though, they reiterate their outperform rating and C$36 12-month price target.

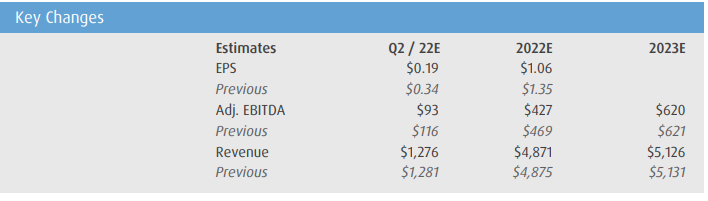

BMO said they are lowering their earnings per share estimate from $0.34 to $0.19, with the consensus estimate being $0.33. BMO believes the company’s meat protein and plant protein segments will come in lower than expected while inflationary pressures add to the headwinds.

On the company’s meat protein segment, BMO says that their data indicates that the primary pork processing margin and hog prices have decreased from US$6.35/cwt to US$2.79/cwt on a year-over-year basis.

They say that this margin is “well below the historical average levels,” but believe that the hedges Maple Leaf Foods put on will be effective and will not have any additional impacts on the company’s earnings.

Though the company has introduced some price increases in early April 2022 to help the company’s margins, BMO does believe that these increases will basically be zeroed out by inflation and suggest that these April price increases are “unlikely to be sufficient.” On top of inflationary pressures, they also expect labor and supply chain constraints to add to the company’s poor margins. BMO has lowered its gross margin estimate for the meat segment to 17%, down from 19%.

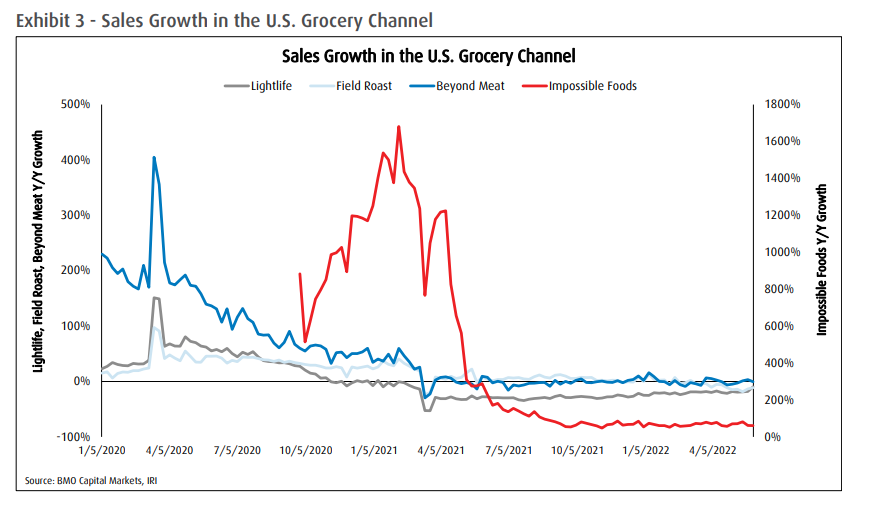

On the plant protein segment, BMO says that their data suggests that both Lightlife and Field Roast sales continue to decline with a sharp accelerated decline starting in April.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.