Last week, The Valens Company (TSX: VLNS) reported fourth quarter and year end financial results. The company reported fourth quarter revenues of C$16 million and a net loss of C$16.6 million. For the full year, the company reported net revenue of C$83.8 million.

Valens currently has eight analysts covering the company with a weighted 12-month price target of C$3.51. This is slightly down from the average before the results, which was C$3.96. One analyst has a strong buy rating, while the majority, six analysts, have buy ratings. Only one analyst has a sell rating on the company.

In Canaccord Genuity’s note, analyst Shaan Mir lowered their 12-month price target to C$3.50 from C$4.50 and reiterated their speculative buy rating on the name. He says that the earnings were generally in-line with their guidance and management guidance altogether. Although he writes, “we are encouraged to see increased momentum in Valens’ transitions to end-product sales.” He believes Valen’s true potential has not been unlocked as it’s platform has largely remained untapped. He expects this to change as the company increases its utilization rate at its K2 facility.

Mir goes onto say that with the K2 facility being operational, the company is the premier cannabis 2.0 manufacturer and platform. He writes, “The company currently offers five extraction types, along with capabilities to develop a complete suite of products at scale.” He believes that additional capacity and manufacturing infrastructure should act as a positive tailwind to its performance. He also believes that the balance sheets of partners and the space in general will help provide additional sales to Valens going into the second half of 2021.

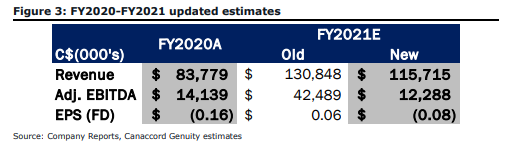

The reason Mir has lowered their price target on Valens is that they have lowered their margin assumptions for the company after seeing price compression in the sale of bulk extracts. Below you can see the key changes made by Mir for their 2021 outlook.

Onto Raymond James’ analysis of the earnings, they are the only investment bank to hold the underperform/sell rating on the name and have a C$2 price target. Rahul Sarugaser, their cannabis analyst, says that the biggest competitive advantage that Valens has over its peers is the large array of manufacturing. He writes, “We also see VLNS putting this one area of particular strength in jeopardy by competing with its own customers: a strategy with which we firmly disagree.” He also calls Valens fourth quarter/year-end financials a non-event and elects to focus on 2021.

On another harsh note, Sarugaser says that even though, like in other markets, 2.0 market share will grow from the 4.9% that is it now to roughly 50%, he believes that Valens offers no competitive advantage to its well-capitalized peers such as Auxly and Indiva. He writes, “as VLNS tries to expand its C2.0 sales, it will be in direct competition with its own customers as part of its white label manufacturing business, jeopardizing its single area of competitive advantage.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.