The earnings season has started off with a bang as Netflix (Nasdaq: NFLX) closed its first post-earnings session down 36% to $222. This comes after the company reported it’s first quarterly subscriber decline while forecasting there will be another quarter of subscriber losses.

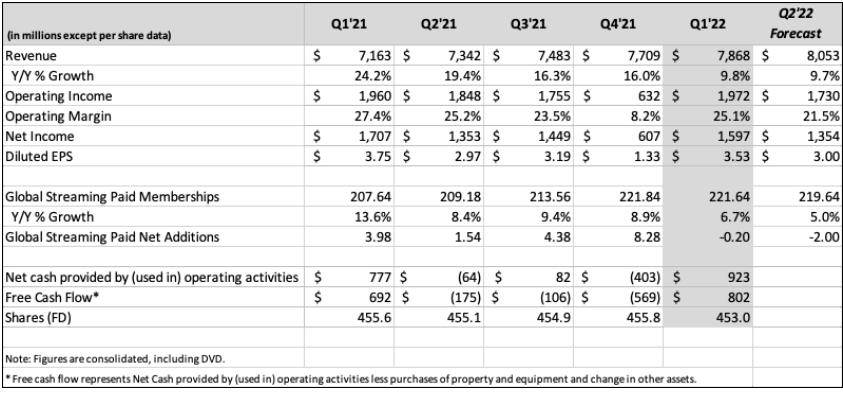

The company said its paid memberships for the first quarter was 221.64 million members, down from the 221.84 million at the end of 2021. This is below Netflix’s own guidance of 2.5 million net additions. This firm blamed the loss as a result of the company shuttering its operations and services in Russia, which accounted for a 700,000 impact. However, net subscriber loss was seen in the US and Canadian segment, as well as EMEA, and LATAM, with growth only coming from the APAC region.

They say that the main issue for growth was due to “continued soft acquisition across all regions.” Additionally, Netflix is guiding total paid memberships for the second quarter of 2021 to be 219.64 million, down 2 million from this quarter’s results.

Onto their other results, Netflix saw its revenue grow almost 10%, slower than the preview COVID induced quarters, to $7.71 billion, with a net income of $1.6 billion and earnings per share of $3.53. On the slowed revenue growth, Netflix said that it is evidenced by their high household penetration that there is a lot of account sharing occurring which “is creating revenue growth headwinds.”

Netflix estimates that their services are being shared by 100 million people globally, which they say isn’t the singular headwind for the paid subscriber growth, but is coupled with “factors we don’t directly control” such as the adoption of on-demand entertainment and data costs. These headwinds together mean that Netflix is having a harder time growing membership in many markets.

With the less than spectacular results, multiple analysts have slashed their 12-month price targets on Netflix, bringing the average 12-month price target down to $368.4, down from the average of $509.50 before the results. There are 47 analysts covering the stock, of which 8 have strong buy ratings, 8 have buy ratings, 27 have hold ratings, 3 have sells and 1 analyst now has a strong sell rating on the stock. The street high sits at $735, or a 118% upside to the current stock price.

In BMO’s note on the results, they reiterate their outperform rating but slash their 12-month price target to $405 from $640, saying that Netflix is now trading as growth at a reasonable price or GARP. They believe that management has done a good job at providing a strong narrative for the results.

They say that Netflix has now conceded to advertising, and mechanically impairing the member/subscriber metric through disclosure of 100 million “password sharers.” With that, they say that Netflix is trading roughly at 13x their new 2024 adjusted EBITDA estimate but remove their “top pick” rating to the stock due to near-term headwinds.

Though BMO does not go into detail on their thoughts on the results, they focus on one thing, being Netflix’s situation around ads, though they admit that the company is unlikely to “reinvent the wheel.” Investors should expect the company to focus on branding versus direct response, starting with engagements into “established private marketplace programmatic pipes.”

They offer a number of potential advertising partners such as TDD, their long-lasting relationship with ROKU or MNGI which is the leading connected television supply side platform for ad sales. BMO believes there will be a split between in-house/proprietary ad tech and outsourcing. The reason for this is because Netflix will want to ensure a gold standard for privacy reasons while also leveraging Netflix’s own customer data and strong engineering culture.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Great work young justin.