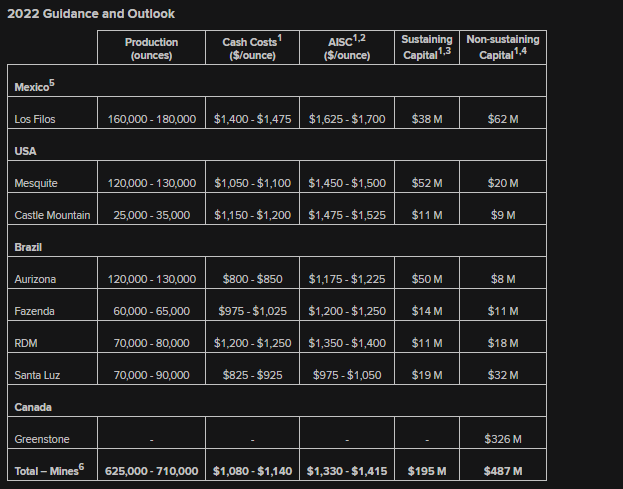

At the end of January, Equinox Gold Corp. (TSX: EQX) announced its 2022 production guidance. The company expects to produce between 625,000 and 710,000 ounces of gold with a cash cost of $1,080 to $1,140 per ounce. The all-in sustaining cost is expected to be between $1,330 to $1,415 per ounce. While the company expects to spend $195 million on sustaining capital and an additional $487 million on non-sustaining capital.

Equinox Gold currently has 12 analysts covering the stock with an average 12-month price target of C$13.13, or a 74% upside to the current stock price. Out of the 12 analysts, 1 has a strong buy rating, 8 have buy ratings and 3 analysts have hold ratings. The street high sits at C$20, which represents a 164% upside while the lowest comes in at C$10.

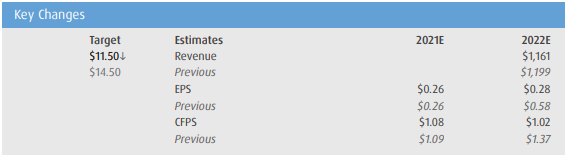

In BMO Capital Markets’ note, they reiterate their outperform rating but lower their 12-month price target to C$11.50 from C$14.50 after they lowered their production estimates to better match guidance. Their prior estimates were roughly 3% higher than the mid-point guidance.

BMO expected 2022 production to be 687,000 ounces of gold with singular mines being in line with their guidance other than RDM and Mesquite being slightly better, while the firms Los Filos’ estimate is 35,000 ounces lower than BMO’s estimate.

For costs, BMO says inflation has finally hit the company, with all-in sustaining costs coming in 19% higher than their $1,150 per ounce estimate, while the $326 million investment into Greenstone is roughly in line with their estimates.

Lastly, they say that Los Filos is still playing catch up, keeping their all-in sustaining cost elevated. BMO writes, “Given the social issues the mine faced last year, the mine is now undergoing an investment intensive period with wastes tripping campaigns at the Los Filos.” This has put the mine-specific all-in sustaining costs at $1,625 to $1,700 per ounce.

Below you can see BMO’s updated 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.