fuboTV (NYSE: FUBO) reported their second quarter financial results on August 10 after hours. The company reported record revenues, which came in at $130.9 million, an 196% increase year over year. The company reported operating expenses totaling $216.4 million, up 76.5% year over year. The company continues to grow subscribers, it reported second-quarter subscribers at 0.682 million, up 138% year over year. Hours streamed also grew to 245 million and ARPU grew to $71.43, up 30% year over year.

3 analysts raised their 12-month price targets on fuboTV after the results. Now, the 12-month average price target sits at $42.86, up from $39.50 last month. The company only has 7 analysts with coverage on the stock, 3 have strong buys, another 3 have buys and 1 analyst has a hold rating. The street high comes in at $60 from Needham & Company, while the lowest price target sits at $30.

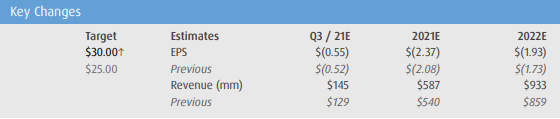

BMO Capital was one of the firms to raise their 12-month price target on fuboTV. They now have a $30 price target, up from $25, and reiterated their market perform rating, saying that the company has been winning vMVPD share due to its first-mover advantage in sports. This combined with the company announcing its online gambling increases the likelihood of continued success.

For the specific results, BMO had subscribers estimated at 605.4 thousand, slightly higher than the consensus, which fuboTV beat handily. Total revenue also beat both BMO’s $123 million and consensus $122 million estimates. Management also guided for full-year subscribers and revenue, 910-920 thousand and $560-$570 million, respectively.

BMO says that management is guiding for 50% of the vMVPD subs to use the sportsbook app “over the next several years,” which should help contribute to $10-$15 ARPU with a 50% gross margin. This shows a clear way for the company to grow its sports betting segments.

Below you can see BMO’s updated third quarter, 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.