Endeavour Silver Corp. (TSX: EDR) reported its first quarter financial results this past week. The company reported revenues of $57.7 million this quarter, up 67% year over year. Though the company’s net earnings came in flat on a year-over-year basis as inflation has eaten into gross profits. The company saw its net income for the quarter come in at $11.7 million.

CEO Dan Dickson commented on the results, saying, “Our first quarter performance was strong, putting us on track to achieve our 2022 production guidance.”

Endeavour said its mine operating income grew 258% year over year to $20.3 million this quarter, while its mine operating cash flow before taxes grew 101% year over year to $26.7 million.

On the production results, the company produced 1,314,955 ounces of silver and 8,695 ounces of gold, an increase of 25% for silver production while their gold production dropped 22% year over year. This puts the company’s total silver equivalent ounces produced to 2,010,555, or an increase of 4% year over year. Additionally, the company processed 206,147 tonnes, flat year over year.

Endeavour says that the cash cost to produce one ounce of silver was $10.21, up 30% year over year, while the all-in sustaining costs per silver ounce were $15.13 this quarter. The company sold 1,717,768 ounces of silver at a realized price of $24.38, down about 10% from last year. They also sold 8,381 ounces of gold at a realized price of $1,970, up 16% year over year.

Endeavour Silver currently has 7 analysts covering the stock with an average 12-month price target of C$7.12, which represents a 65% upside to the current stock price. Out of the 7 analysts, 2 have buy ratings and the other 5 have hold ratings. The street high sits at C$11.04, or an upside of 155%.

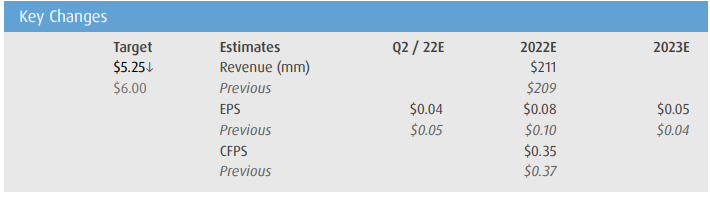

In BMO Capital Markets’ note on the results, they reiterate their market perform rating and lower their 12-month price target from C$6.00 to C$5.25, saying that the change is primarily from rolling forward estimates.

On the results, BMO says that the adjusted EPS of $0.07 Endeavour Silver reported came in better than their $0.04 estimate. While the other highlight BMO talks about is the company’s cash flow from operations, which came in line with their $21.7 million estimates.

While BMO notes that Endeavour’s revenue was $57.5 million, which includes a good portion of inventory on hand, they say that the additional metal sales were previously telegraphed.

Below you can see BMO’s updated estimates on Endeavour Silver.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.