Kinross Gold (TSX: K) this past week announced that it is launching a new share buyback program, buying back $300 million in shares over the remainder of 2022, and will allocate 75% of its excess cash to fund buybacks in 2023 and 2024. Kinross says that this announcement came after “constructive discussions” with Elliott Investment Management and other large shareholders.

Kinross’s President and CEO commented saying, “Management met with Elliott a number of times to discuss its views on capital allocation and value creation. We share a common view that our shares offer a highly compelling investment opportunity and as a result believe that a more substantial share buyback program is a highly attractive use of excess cash.”

While Elliott publically commented, saying, “Kinross today possesses a high-quality, Americas-focused portfolio with strong potential for future growth through Great Bear, yet it trades at a significant discount to both its peers and to the value of its assets. We believe that with this new capital-allocation framework, Kinross is taking a major step toward closing that gap and realizing the upside potential in its stock.”

Kinross Gold currently has 11 analysts covering the stock with an average 12-month price target of C$8.18, or an upside of 70%. Out of the 11 analysts, two have strong buy ratings, six have buy ratings and the last three analysts have hold ratings on the stock. The street high price target sits at C$10, coming from two analysts, and represents an upside of 108%.

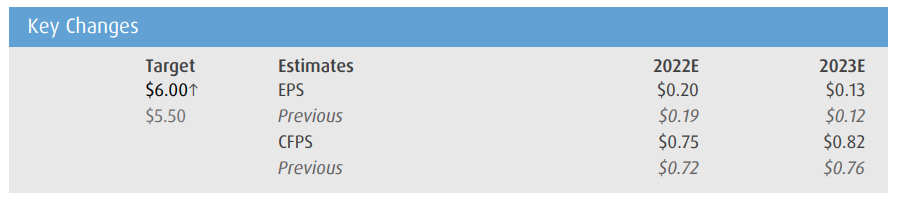

In BMO Capital Markets’ note on the news, they reiterate their outperform rating and raised their 12-month price target to $6.00 from $5.50, saying that the news is positive.

Additionally, since the buyback is so large, BMO has implemented the buyback into their estimates. They project that Kinross will complete the announced $300 million in buybacks during the fourth quarter, which has brought their earnings per share estimate up from $0.19 to $0.20. Though they estimate that Kinross will not be able to fund any additional buybacks in 2023 and 2024 as free cash flow after normal dividends and interest is negative.

Lastly, BMO continues to believe that this is the environment for mining companies to announce buybacks. Just like Elliott, BMO believes that Kinross is “attractively valued,” especially after Russia’s invasion of Ukraine, which saw Kinross suspend, close, and sell its Russian assets.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.