At the end of October, Eldorado Gold (TSX: ELD) reported its third quarter financial results. The company reported revenues of $238.4 million. The company produced 125,459 ounces of gold and sold 125,189 ounces this quarter, while the average gold price was $1,769 per ounce with an all-in sustaining cost of $1,133. Free cash flow of $29.7 million and cash and equivalents of $439.3 million totaled at the end of the quarter.

Eldorado Gold has 12 analysts covering the stock with an average 12-month price target of C$17.29 or a 47% upside. Out of the 12 analysts, 6 have buy ratings, 5 have hold rating and a single analyst has a sell rating on the stock. The street high sits at C$22.20 from CIBC Capital Markets while the lowest sits at C$10.92.

In BMO Capital Markets’ third quarter review, they reiterate their outperform rating and C$20 12-month price target saying that the company is finally finding stability.

For the quarter, Eldorado Gold reported an adjusted earnings per share of $0.22, coming in line with BMO’s $0.21 estimate. BMO says that the beat was primarily due to the companies all-in sustaining cost coming in lower than their estimate of $1,184. They write, “Eldorado executed on both the production and cost side this quarter, delivering beats on both earnings and its pre-released production.”

BMO believes that Eldorado will hit their upgraded production guidance of 460,000 – 480,000 for the full year 2021. Currently, the company has produced 353,000 ounces as of the third quarter and BMO expects all of Eldorado’s operating mines will meet or beat original 2021 production guidance.

Lastly, BMO says that the Kisladag and Lamaque mine construction is on pace and that the company is well-financed to continue to put money into new growth projects.

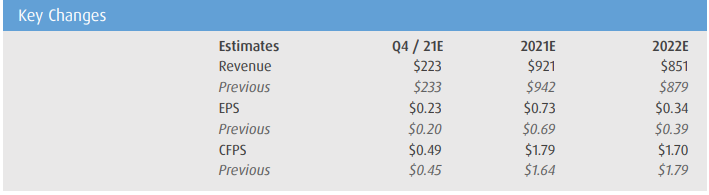

Below you can see BMO’s updated fourth quarter, 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.