Last week, Kirkland Lake Gold Ltd. (TSX: KL) announced their second quarter production figures. Results reflected a record quarter for the company at 379,195 ounces, a 15% increase from the second quarter and 25% higher year over year. The company also reiterated that they are on track to meet 2021 production guidance of 1,300,00 – 1,400,000 ounces of gold. The company is halfway to their guidance, having produced 682,042 ounces year to date.

Two analysts, JP Morgan and National Bank, changed their 12-month price target on the company following the results. This brought the average 12-month price target down to C$66.23. The street high sits at C$80 from M Partners, while the lowest sits at C$50. The company has 11 analysts covering the company. Four analysts have strong buy ratings, five have buy ratings, one analyst has a hold rating and the other analyst has a sell rating.

In BMO’s note, their analyst Brina Quast reiterated their outperform rating and C$72 price target, saying that the production results beat analyst expectations. BMO’s analyst estimated that the company would produce 330,200 ounces, and believes that the beat is almost entirely attributable to strong grades at Fosterville and higher-than-expected grades and tonnage from the Swan Zone.

Quast believes that Kirkland’s full year production will come in closer to the high end of guidance. He believes Detour Lake and Macassa production to be heavy in the second half of 2021. But, since much higher grade stopes moved from 4Q21 to 1Q21 at the Swan Zone the second half of 2021 could be lighter than expected.

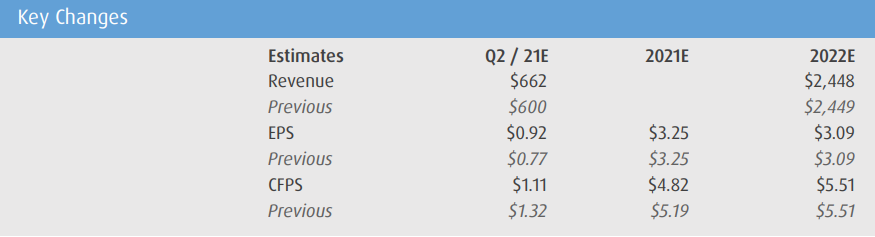

Below you can see BMO’s second quarter, 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.