On November 29, MAG Silver (TSX: MAG) closed their US$46 million offering wherein the company issued 2.69 million shares, which included 15,700 shares to MAG insiders at US$17.15 per share. The company stated that they intend to use the proceeds of the offering, “to fund exploration on Juanicipio and its other projects including Deer Trail, and to fund certain sustaining capital requirements at the Juanicipio Project not included in the initial project capital estimates, and for working capital and general corporate purposes.”

MAG Silver currently has 10 analysts covering the stock with an average 12-month price target of C$28.83, or a 39% upside to the current stock price. Out of the 10 analysts, 7 have buy ratings and the other 3 have hold ratings. The street high sits at C$33.82 from Roth Capital while the lowest comes in at C$24.75.

On the 29th, BMO Capital Markets resumed their coverage on MAG Silver, reiterating their C$25 12-month price target and market perform rating. BMO says that this raise will help fund exploration and get Juanicipio across the finish line.

Additionally, it will help keep the companies cash balance strong. The company ended the third quarter with US$31.7 million. With this additional US$40 million on hand, they expect the company to make a $30 million capital contribution to their joint venture sometime in December. That will top the joint venture up to US$68 million in cash and MAG with roughly $34 million in cash, plus the cash flow from the business. They believe that MAG Silver will end out 2021 with US$44 million in cash.

BMO has updated their net asset value but believes the raise has only a modest impact since the increase in shares is roughly 3% with the overallotment, bringing the total shares outstanding to 97.8 million. This brings their NAV assumption to US$10.29 from US$10.19 prior.

Lastly, BMO says that the company is getting close to Juanicipio ramping up. The company noted that the plant is expected to come in on budget and expected to be completed by year-end.

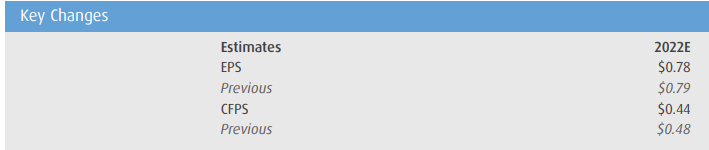

Below you can see BMO’s full year 2022 assumptions.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.