On October 21st at 11:28 PM, Rogers Communications (TSX: RCI) announced a change of directors with the Control Trust Chair leading the change, saying “The Control Trust Chair is disappointed with recent events and commentary regarding the governance of RCI and has lost confidence in the Board of RCI as currently constituted.” The Control Trust currently owns 97.53% of the Class A shares, effectively bypassing the approval of at least 66.6% of the holders.

Surprisingly, only 15 analysts cover Rogers Communication with an average 12-month price target of C$71,93 or a 20% upside. Out of the 15 analysts, 3 have strong buy ratings, 9 have buys, 2 have holds and 1 analyst has a sell rating. The street high sits at C$80 from Scotia Bank while the lowest comes in at C$64.

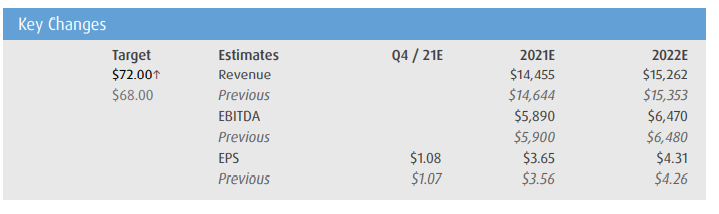

BMO Capital Markets raised their 12-month price target to C$72 following the company financial results, the note looks to have come out before the drama talked about above. BMO Capital Markets says that they have raised the 12-month price target due to a governance resolution.

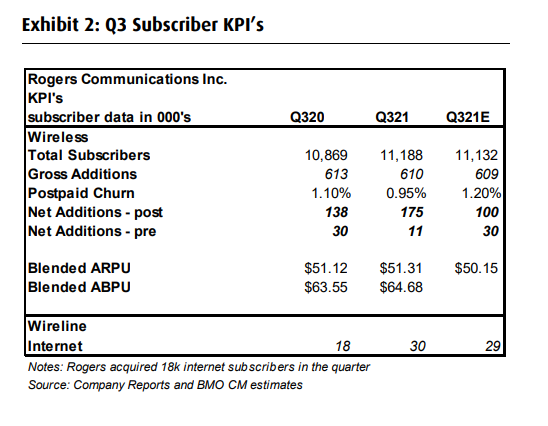

For the third quarter, revenues came in flat at $3.666 billion, slightly lower than the consensus $3.681 billion. EBITDA came in 2% lower to $1.6 billion while free cash flow came in at $507 million, down from the $868 million last year. BMO calls the operating metrics and wireless financials solid, with the company reporting 2.9 million unlimited customers, an increase of 200,000.

Below you can see BMO’s updated 2021 and 2022 estimates which include a “modest increase” in their CAPEX estimates for 2022 and 2023.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.