Last week, BMO Capital Markets’ hosted Suncor Energy (TSX: SU)‘s President and CEO Mark Little for in-person meetings in Toronto with investors. Subsequentially, they reiterated their outperform rating and raised their 12-month price target to C$60 from C$54.

The stock is currently up almost 60% year to date to C$52.78 and has 20 analysts covering the stock with an average price target of C$53. Out of the 20 analysts, 2 analysts have a strong buy rating, 11 have buy ratings and the last 7 analysts have hold ratings. The street high price target comes in at C$63, or an upside of about 20%.

In BMO’s note on the meetings, they say that some of the key discussions included capital allocation, downstream performance, safety and reliability, and free cash flow initiatives.

On capital allocation, the company’s CEO said they plan to fully execute on buying back 10% of the company’s shares via a buyback and have reiterated a plan to spend 100% of their free cash flow. Of which 50% will go to share buybacks and the other 50% will go to debt reduction.

They expect to do this until debt drops down to $12 billion, which is expected to happen in the second half of this year. Then they will allocate 75% of their free cash flow into buying back their shares. When the company reaches $9 billion in debt, it will allocate all free cash flow to buying back shares.

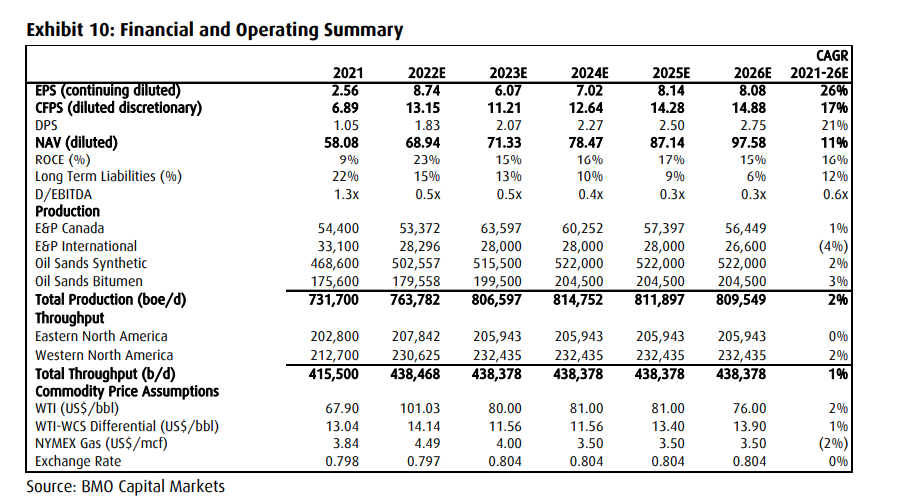

BMO expects that the company will exit 2023 with net debt being $6.2 billion. They model Suncor’s free cash flow will be $14.7 billion and $13.6 billion for 2022 and 2023, respectively. They expect that the company will generate roughly $60 billion in free cash flow over the next 5 years and if strip prices were to expand by $20/bbl they believe this would increase free cash flow by $20 billion to $80 billion.

On the downstream business, management said that the segment’s profitability is “to be well above 2018/2019 levels,” which were record years for the company. Management believes that “it has the premier retail business in Canada and that it provides a competitive advantage.”

BMO notes that the Canadian refining market seems to fair better than the U.S market, “due to geographic constraints that limit import competition as well as a tighter overall market due to rationalized capacity,” and that the Canadian refiners also see lower feedback costs.

Lastly, they say that historically Suncor’s shares have traded in the middle of its peer group but have recently traded at the lower end of the group. They believe this “discount” is unjustified due to “its leading downstream operations, improvements made to its free cash flow profile, and its ability to return large amounts of cash to shareholders,” and they expect Suncor’s valuation to improve.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.